64.7 billion for the budget: how the Ministry of Finance raised a record amount through bonds

4 November 11:32

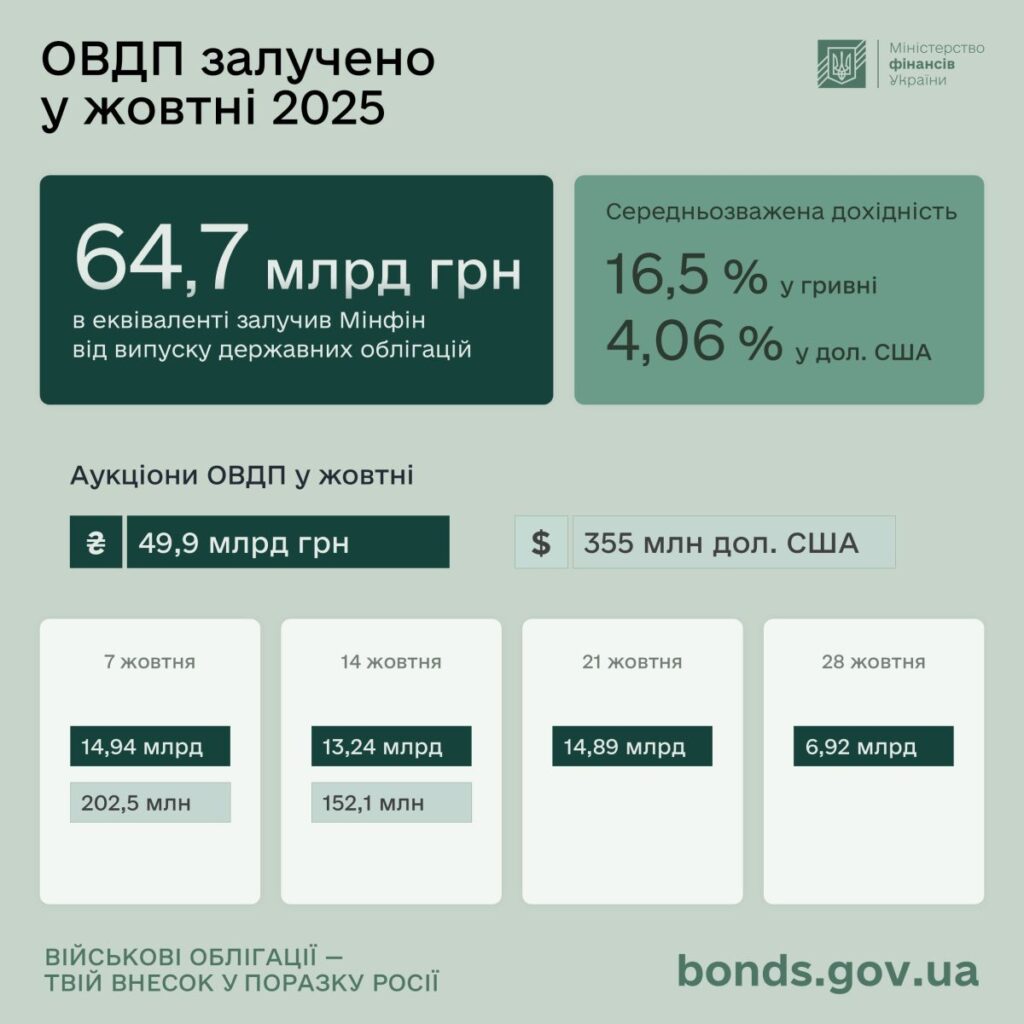

In October 2025, the Ministry of Finance of Ukraine raised UAH 64.7 billion in equivalent to the state budget through the sale of domestic government bonds (OVDPs). This is evidenced by the data of the Ministry of Finance of Ukraine on the results of the placement of domestic government bonds in October 2025, "Komersant Ukrainian" reports

Of these, UAH 49.9 billion are hryvnia bonds with a weighted average yield of 16.5% per annum, and another USD 355 million are foreign currency government bonds with a yield of 4.06% per annum.

A government bond is essentially a loan to the state: citizens, businesses, or banks buy the securities, the state receives the money, and later returns it with interest.

How many bonds are currently in circulation

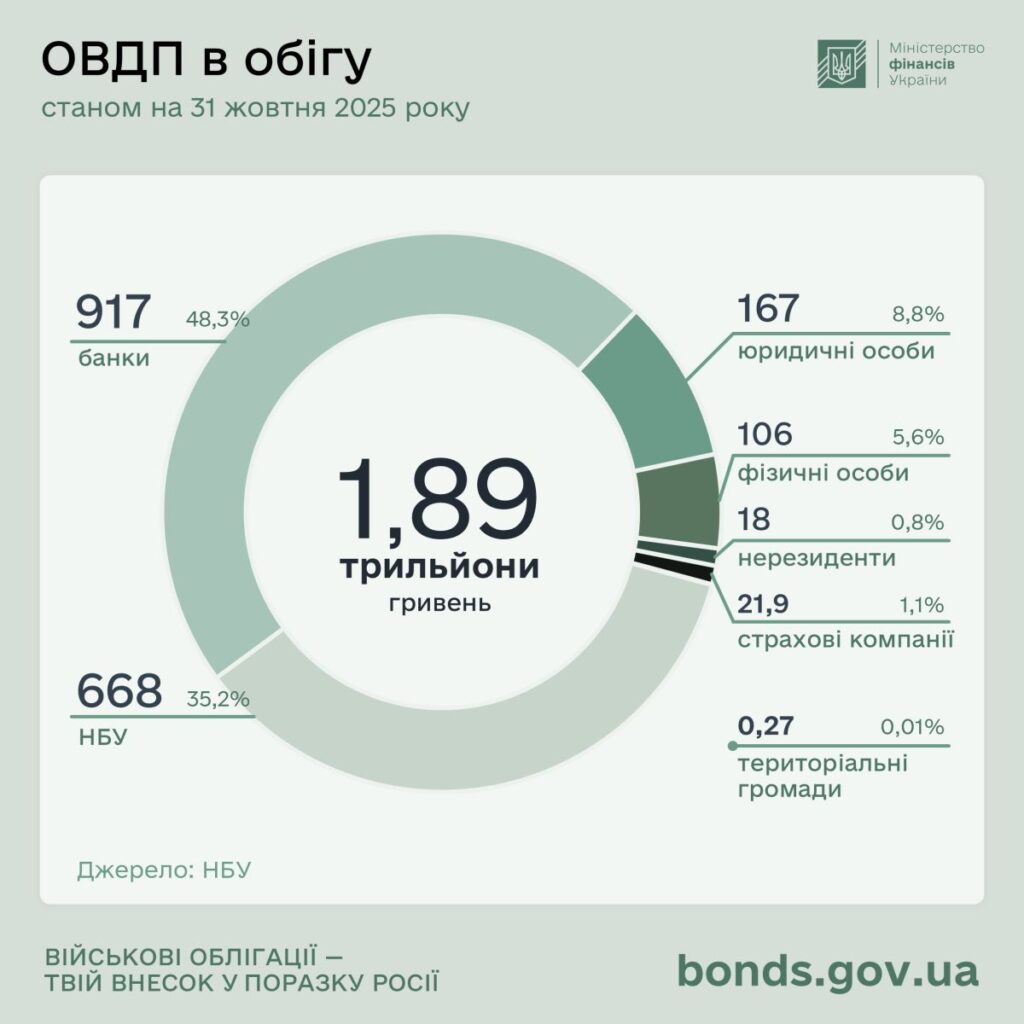

As of October 31, 2025, there are more than UAH 1.89 trillion worth of government bonds in circulation.

The main holders are:

- commercial banks – 48.3%;

- The National Bank of Ukraine – 35.2%;

- legal entities – 8.8%;

- individuals – 5.6%;

- non-residents – 0.8%;

- insurance companies – 1.1%;

- territorial communities – 0.01%.

Compared to October 2024, the volume of investments by legal entities and individuals increased by 27.5%.

Ukrainians now hold domestic government bonds worth more than UAH 106 billion, and businesses – more than UAH 166.7 billion.

What is a switch auction and why is it important?

on October 22, the Ministry of Finance held the fourth switch auction, which is the exchange of old bonds for new ones with a longer maturity.

At this auction:

- 21 applications for UAH 17 billion were submitted,

- uAH 15.5 billion of bids were satisfied,

- investors exchanged securities maturing in November 2025 for new ones with a maturity of July 2029,

- the yield of the new securities is 14.89% per annum.

This mechanism allows the government to reduce the burden on the budget and at the same time maintain investor interest in long-term instruments.

What role do domestic government bonds play in budget financing?

Since the beginning of 2025, the Ministry of Finance has already placed domestic government bonds for over UAH 473.1 billion.

This is the second largest source of state budget financing after international aid.

Since the beginning of the full-scale invasion, the total amount of funds raised through domestic government bonds has exceeded UAH 1.89 trillion.

These funds help finance social spending, support the army and stabilize the economy.

Watch us on YouTube: important topics – without censorship

How to buy military bonds

The government bonds can be purchased by all citizens, not just banks or large companies.

The purchase is available in:

- the Diia app,

- banks (e.g., PrivatBank, monobank, Oschadbank, PUMB, Ukrgasbank, etc,)

- or through brokers.

The nominal value of one bond is UAH 1000, USD 1000 or EUR 1000.

Step-by-step instructions via Diia:

- In the “Services” section, select “Military bonds”.

- Define the type of bonds – for example, with the names of Ukrainian cities or territories.

- Choose a bank or broker.

- Fill in contact details and, if necessary, add a ePay card.

- Sign the documents and pay for the bonds.

In this way, Ukrainians not only receive income but also financially support the state in wartime.

Read us on Telegram: important topics – without censorship