Bitcoin fell to $82.5 thousand: what happened to the cryptocurrency market and why investors are panicking

21 November 13:15

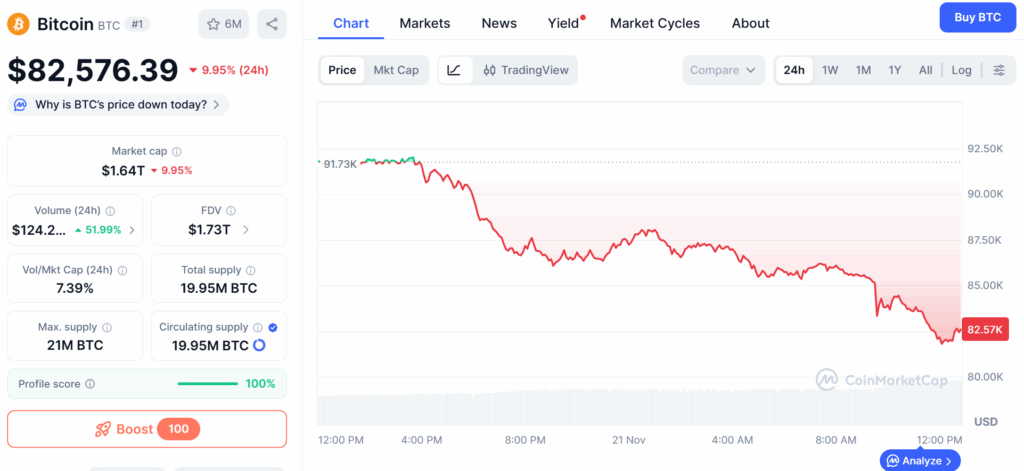

On the morning of November 21, the value of bitcoin dropped below $82.5 thousand. Other cryptoassets with the largest capitalization also showed a drop, according to CoinMarketCap data.

At the time of writing, the cryptocurrency was trading at about $84,576, approaching its lowest level in the last year.

Over the week, bitcoin fell by 13.3%.

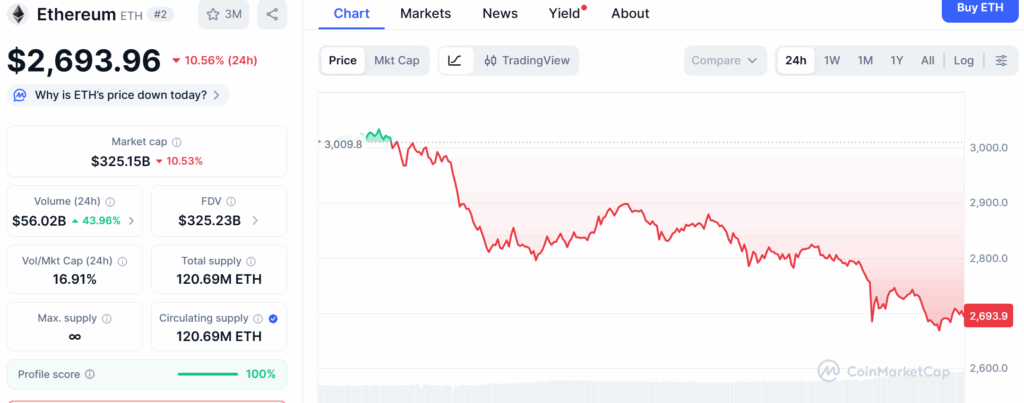

Ethereum also fell by more than 2%, hitting a four-month low of $2,693.96.

The decline was not limited to the top assets: the market as a whole lost part of its capitalization, and digital assets continue to weaken.

Why the crypto market is falling rapidly

This drop is an indicator of the fragility of sentiment in the cryptocurrency market. According to analysts, if bitcoin, which is a “barometer of risk appetite,” continues to fall, the market situation may worsen, Reuters reports.

Over the past six weeks, the total market capitalization of all cryptocurrencies has lost about $1.2 trillion.

The current decline is particularly sharp as bitcoin has experienced stellar growth, reaching a record high of over $120,000 in October. This was driven by favorable regulatory changes for crypto assets around the world. However, the market remains under pressure after last month’s record crash, when more than $19 billion in leveraged positions were liquidated.

So far, bitcoin has wiped out its entire yearly gain and is down 8% since the beginning of the year, while Ethereum has lost almost 16%. The selloff also affected the shares of cryptocurrency companies such as Strategy and Metaplanet.

CryptoQuant analysts note:

“Bitcoin market conditions are the most bearish since the start of the current bull cycle in January 2023. We are probably seeing that most of the demand wave of this cycle has already passed.”

Monarq Asset Management Managing Partner Shilian Tan said in a commentary for Bloomberg that the current downturn in the crypto market is due to a protracted negative trend associated with a deteriorating overall macroeconomic environment.

According to the expert, the probability that the US Federal Reserve will ease monetary policy in December 2025 has dropped to 50%. Combined with the fact that bitcoin has lost the key support level of $100,000, this stimulates interest in safe instruments such as bonds and gold and negatively affects high-risk investments.

How the ETF market and crypto companies are reacting

Bitcoin exchange-traded funds in Hong Kong have been hit harder than others. On Friday, prices for spot ETFs of companies:

- China AMC,

- Harvest,

- Bosera

fell by 7% each.

In addition, shares of companies that store cryptocurrencies were also affected by the market:

- Strategy (MicroStrategy) lost 11% over the week and is trading at annual lows,

- Metaplanet (Japan) fell by about 80% from its June peak.

Bitcoin and Ukraine: what you need to know

In Ukraine, BTC is recognized as a virtual asset but not a means of payment.

Starting from 2025, profits from cryptocurrency transactions will be taxed at a rate of 19.5%:

- 18% PERSONAL INCOME TAX

- 1.5% military duty

Important: the tax is charged on the entire amount of the transaction, not on the difference between the purchase and sale.

Ukraine is among the top 5 countries in the world in terms of the share of bitcoin ownership among the population.

What does this mean for investors?

The market will remain volatile in the coming weeks.

A short-term drop to new local lows is possible.

Institutional investors may step up purchases after the exchange rate stabilizes.

Leverage holders should proceed with caution due to high liquidation risks.

Read us on Telegram: important topics – without censorship