Financial architecture of Ukraine-2025: bank cards are replacing cash

20 August 2025 17:37 INFOGRAPHICS

INFOGRAPHICS

Ukrainians are increasingly switching to contactless and digital payments. The National Bank of Ukraine (NBU) has released statistics for the first half of 2025, which demonstrates the active development of the payment infrastructure and changes in user behavior, "Komersant Ukrainian" reports.

In the first half of 2025, Ukrainians made transactions with payment cards totaling UAH 3.4 trillion. According to the National Bank of Ukraine, more than two-thirds of these transactions were non-cash.

Ukrainians are withdrawing cash less and less: over 95% of card transactions are non-cash

The amount of non-cash transactions amounted to UAH 2.2 trillion, which is 11.2% more than in the first half of 2024. At the same time, the volume of cash withdrawals increased by only 7.6% to UAH 1.18 trillion.

Thus, the share of non-cash transactions by amount reached 65.3%, while cash withdrawals accounted for only 34.7%.

In total, Ukrainians conducted 4.6 billion card transactions, which is 11.8% more than a year earlier. At the same time, 4.38 billion of them (95.3%) were non-cash transactions. The number of cash withdrawals, on the other hand, decreased by 7.9% to 216.7 million transactions.

The NBU emphasizes that back in 2020, non-cash transactions accounted for only 44.2% of the total. But with the outbreak of a full-scale war, this figure grew rapidly, and in 2022 it exceeded 60%.

In terms of the number of transactions, the transition is even more noticeable: while in 2020, non-cash payments accounted for 86.9%, in the first half of 2025, they already accounted for 95.3%.

The growth in the share of non-cash transactions indicates the deepening of financial digitalization and the active use of modern payment instruments by Ukrainians. The National Financial Regulator emphasizes that this trend makes the economy more transparent, reduces business costs for cash circulation, and promotes the development of financial services.

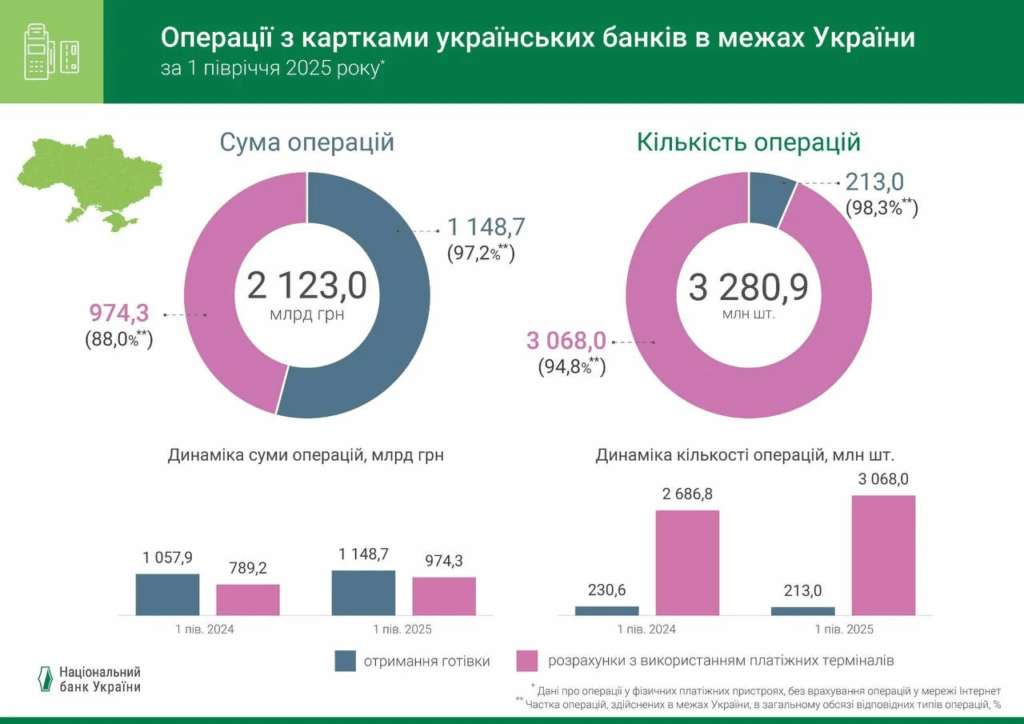

The volume of transactions with cards of Ukrainian banks within the country

In January-June 2025, Ukrainians made domestic card transactions totaling UAH 2,123 billion.

The bulk of these transactions were cash withdrawals. They accounted for 97.2% (UAH 1,148.7 billion) of all cash transactions.

At the same time, payments using payment terminals within Ukraine retain a high share of UAH 974.3 billion, which is about 88% of the volume of such transactions. The number of such transactions exceeded 3,200 million.

The NBU also informed that over 3,280.9 million card transactions were conducted in Ukraine in the first six months of the year. Of these, 3,068 million were non-cash payments in retail chains and through payment devices. Their share is 94.8%.

Compared to the first half of 2024, the dynamics are positive. At that time, the volume of cash transactions amounted to UAH 1,057.9 billion, and non-cash payments amounted to UAH 789.2 billion.

The number of non-cash transactions increased from 2,686.8 million in 2024 to 3,068 million in 2025, which indicates a continuation of the trend towards more active use of cards for non-cash payments.

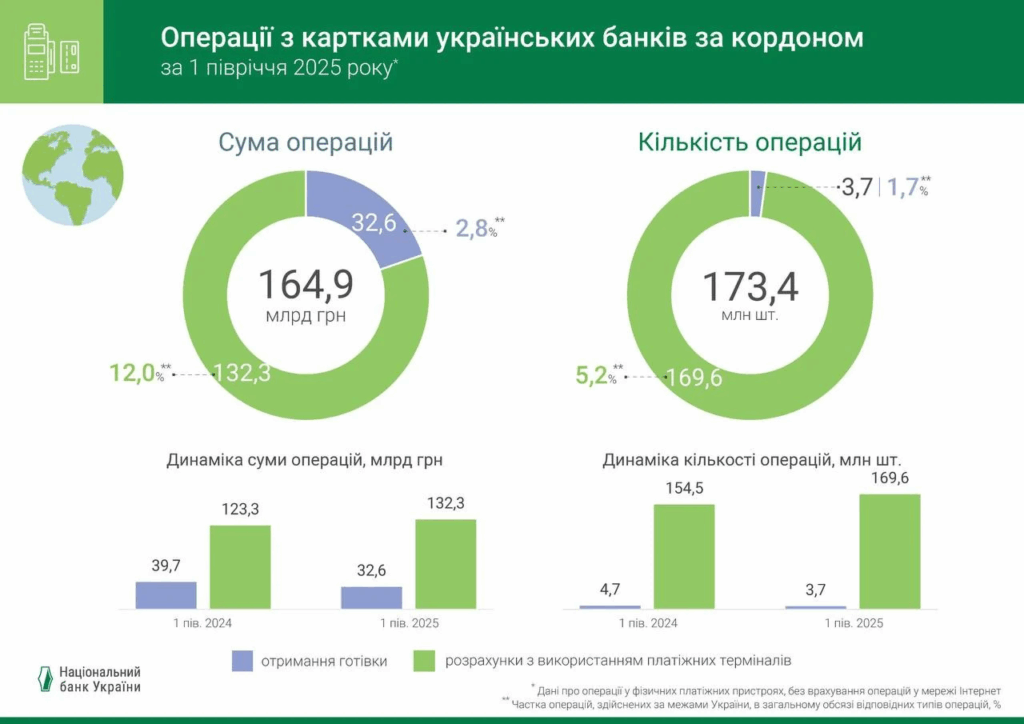

Ukrainians abroad are using cards more actively

In the first half of 2025, Ukrainians outside the country made transactions with cards of Ukrainian banks totaling UAH 164.9 billion. According to the National Bank of Ukraine, this is 12% more than in the same period of 2024.

The bulk of transactions were made in retail chains and through payment terminals. They totaled UAH 132.3 billion, up 7.3% year-on-year.

Cash withdrawals amounted to UAH 32.6 billion. Although their share in the total volume is only 2.8%, the demand for cash abroad remains stable.

Overall, in the first half of the year, Ukrainians made 173.4 million transactions abroad using cards issued by Ukrainian banks. This is 5.2% more than last year.

Cashless payments dominate here as well: 169.6 million transactions (9.7% yoy). At the same time, the number of cash withdrawals decreased from 4.7 million in 2024 to 3.7 million in 2025. Their share in the overall structure is only 1.7%.

The NBU’s data confirm a steady trend: Ukrainians abroad are withdrawing cash less often and using cards more often for direct payments. Financiers attribute this to the convenience, security, and spread of cashless infrastructure in the EU and other countries where Ukrainian citizens are currently residing.

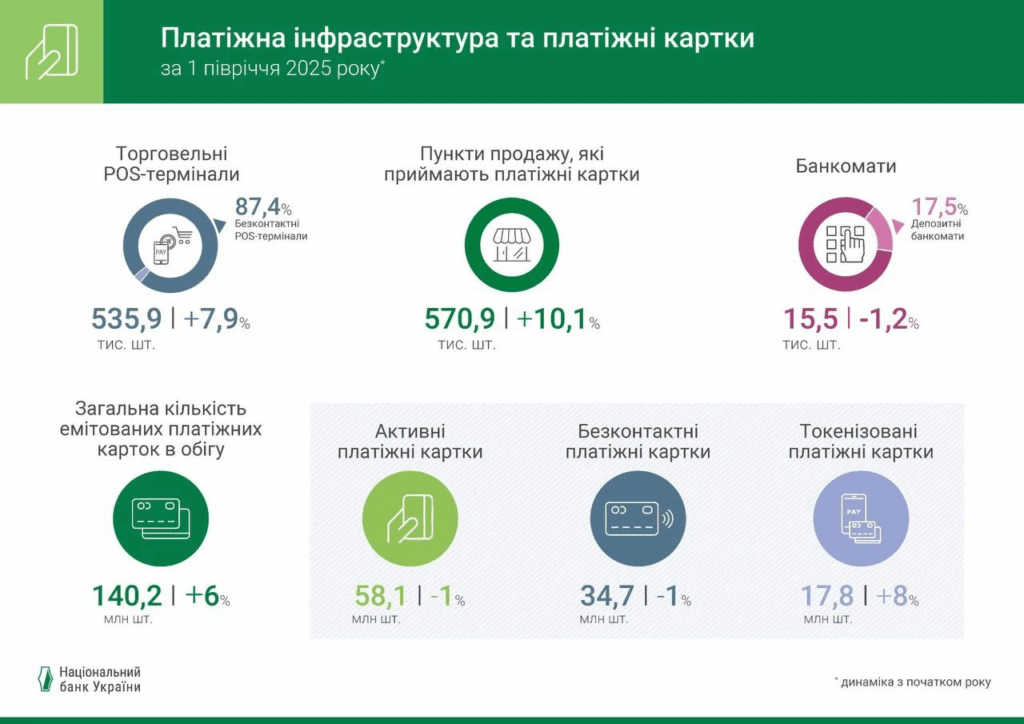

Payment infrastructure in Ukraine: fewer ATMs, but more contactless cards

The number of POS terminals increased by 7.9% to 5359 thousand units. At the same time, 87.4% of them support contactless payments. The number of card-accepting outlets also increased by 10.1% to 570.9 thousand.

In the ATM sector, the NBU recorded a decline in the number of ATMs, which decreased by 1.2% to 15.5 thousand units. The share of deposit ATMs is 17.5%.

The total number of issued payment cards in circulation reached 140.2 million, up 6% year-on-year. At the same time, the number of active cards decreased by 1% to 58.1 million, and the number of contactless cards decreased by the same amount to 34.7 million.

The segment of tokenized cards (added to digital wallets) is growing the fastest: their number increased by 8% to 17.8 million. This indicates the growing popularity of mobile payments and digital financial services.

Read also: Cash instead of an account: why Ukrainians are abandoning bank services en masse

Ukrainians are increasingly making contactless payments

The total amount of non-cash transactions through payment terminals amounted to UAH 1.1 trillion. Contactless payments using NFC gadgets accounted for the largest share, amounting to UAH 671.5 billion or 60.7% of all transactions.

Contactless card transactions accounted for UAH 404.0 billion (36.5%). Traditional payments involving reading the card carrier amounted to only UAH 31.1 billion (2.8%).

In total, the NBU recorded 3.24 billion transactions. More than half of them – 1.9 billion (58.7%) – were payments via NFC gadgets. Contactless card payments accounted for another 39.3% (1.27 billion). Transactions involving physical card reading accounted for only 2% (64.1 million).

Statistics show a steady increase in the popularity of mobile payments, which are confidently outpacing card transactions. This is due to the convenience of NFC technologies and the active use of smartphones and smartwatches with contactless payment functions.

Дивіться нас у YouTube: важливі теми – без цензури

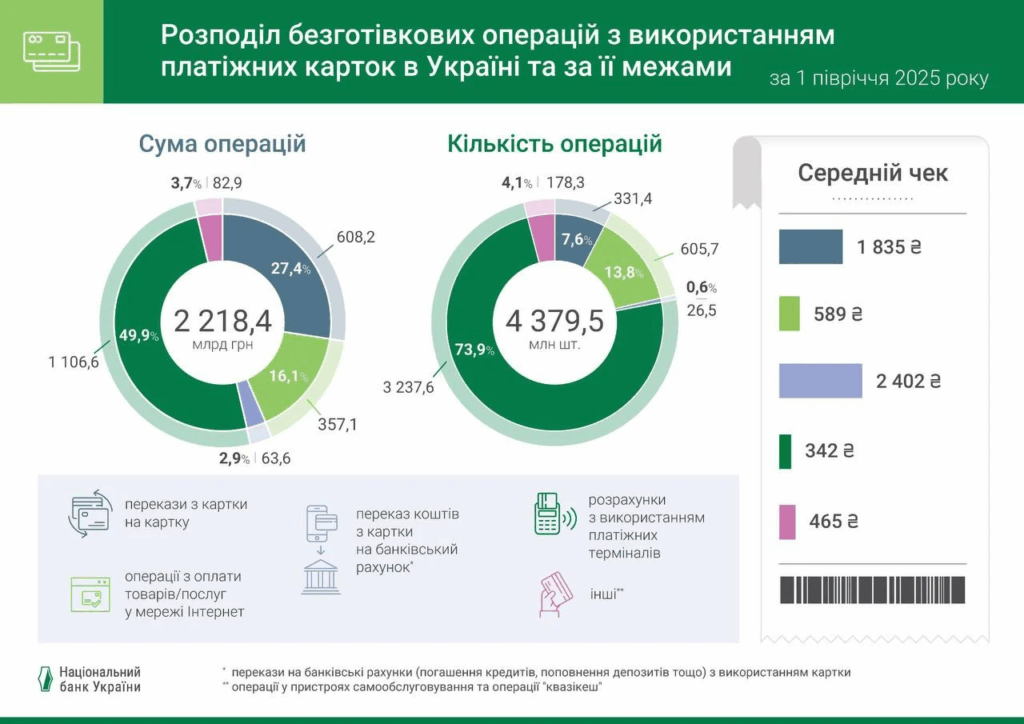

How many non-cash transactions were made by Ukrainians in the first half of 2025

In the first half of 2025, the volume of non-cash transactions using payment cards of Ukrainian banks reached UAH 2.2 trillion, and their number exceeded 4.37 billion transactions.

Card-to-card transfers accounted for the largest share in terms of funds – UAH 1.1 trillion, or 49.9% of the total amount. The second place is occupied by payments in merchant terminals – UAH 608.2 billion (27.4%). This is followed by online payments for goods and services – UAH 357.1 billion (16.1%) and transfers to bank accounts – UAH 82.9 billion (3.7%). Other transactions amounted to UAH 63.6 billion (2.9%).

By the number of transactions, the following dominate:

- settlements in trading terminals – 3.24 billion transactions (73.9% of all transactions);

- internet payments amounted to 605.7 million transactions (13.8%);

- card-to-card transfers – 331.4 million transactions (7.6%);

- transfers to bank accounts – 178.3 million (4.1%);

- other transactions – 26.5 million (0.6%).

The highest average check was in the category “transfers to bank accounts” – UAH 2,402.

For card-to-card transfers, it amounted to UAH 1,835. Online payments had an average check of UAH 589. Payments in trade terminals amounted to UAH 342. The lowest figure was in the category of “other transactions” – UAH 465.

According to the NBU, Ukrainians increasingly prefer payments in retail chains and on the Internet, while the share of classic transfers to bank accounts remains relatively small. This confirms the country’s further transition to a cashless economy and growing confidence in digital payment services.

NBU data shows a steady increase in the popularity of card payments within Ukraine. Ukrainians are increasingly choosing non-cash instruments for everyday spending, while the role of cash is gradually decreasing.

Читайте нас у Telegram: головні новини коротко