Where Ukrainian defense companies are moving to: Top 5 countries of relocation

29 October 10:56

The majority of Ukrainian arms manufacturers are forced to look for safe working conditions abroad. A new survey by the Technological Forces of Ukraine (TSU) has shown that the main reason for the relocation of companies is security risks, as well as export restrictions and insufficient government orders. Among those who have already left or are planning to relocate, the five most popular countries for relocating production facilities stand out, "Komersant Ukrainian" reports

The main reasons for relocation

In addition to security threats, manufacturers named the following factors:

- inability to export products – 61%

- small volumes of state orders in the presence of opportunities to produce more – 56%

- inability to export technology – also 56%.

The survey covered 35 private defense companies and was conducted for the third time.

Relocation dynamics: down for the first time in a year and a half

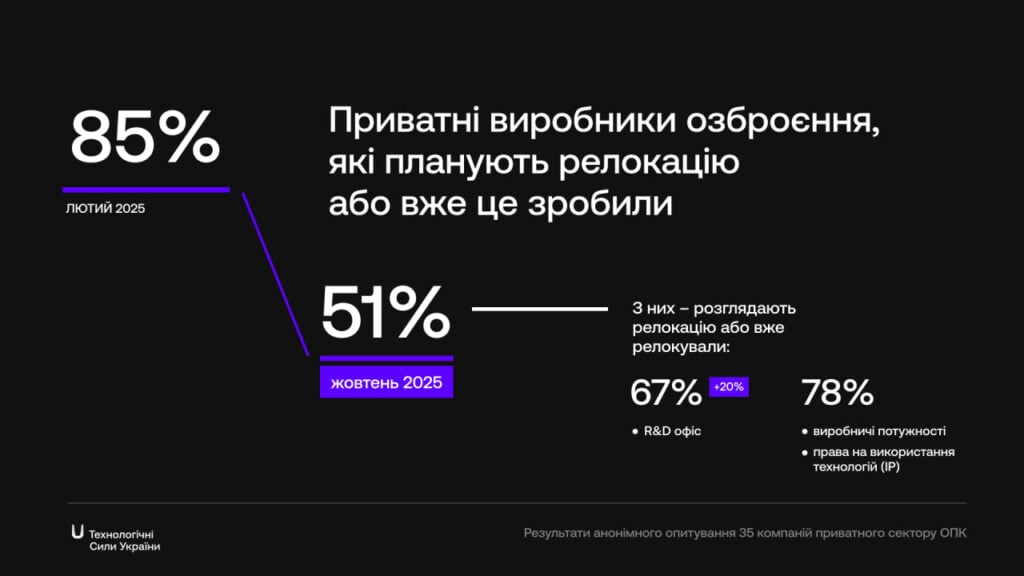

In recent months, for the first time, there has been a decline in the number of companies planning or already relocating – from 85% in February 2025 to 51% in October.

Kateryna Mykhalko, Executive Director of the TSU, explains that this may have been influenced by recent announcements about the opening of controlled exports of weapons and military equipment, which the association has been advocating for over two years.

Where manufacturers are relocating to

Among the companies that have already relocated or plan to relocate part of their operations (51% of respondents):

- 78% are relocating production facilities

- 78% – export technology rights (intellectual property)

- 67% – relocate R&D offices.

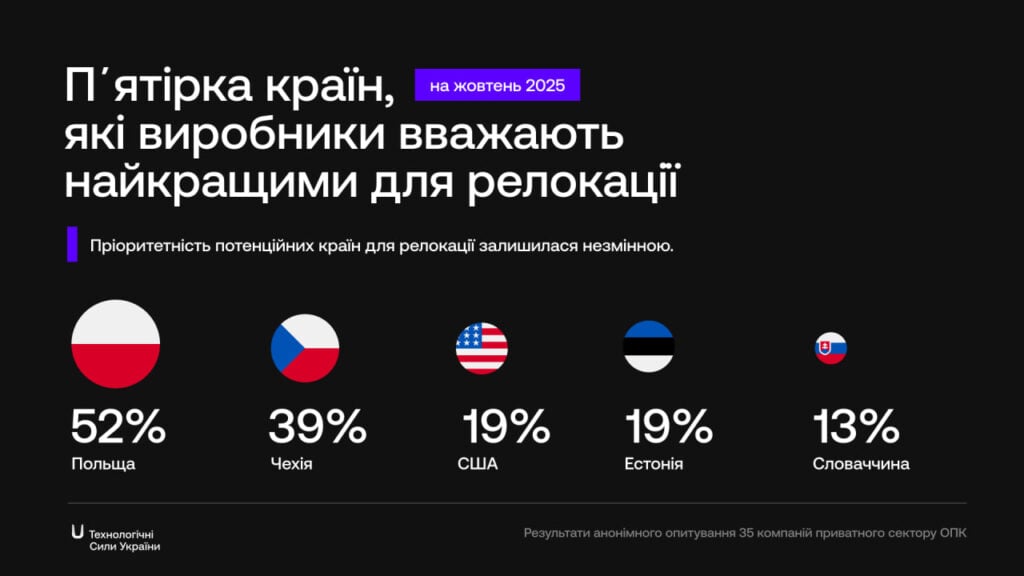

The top countries for relocation remain unchanged: Poland, Czech Republic, USA, Slovakia, and Estonia.

What can stop relocation

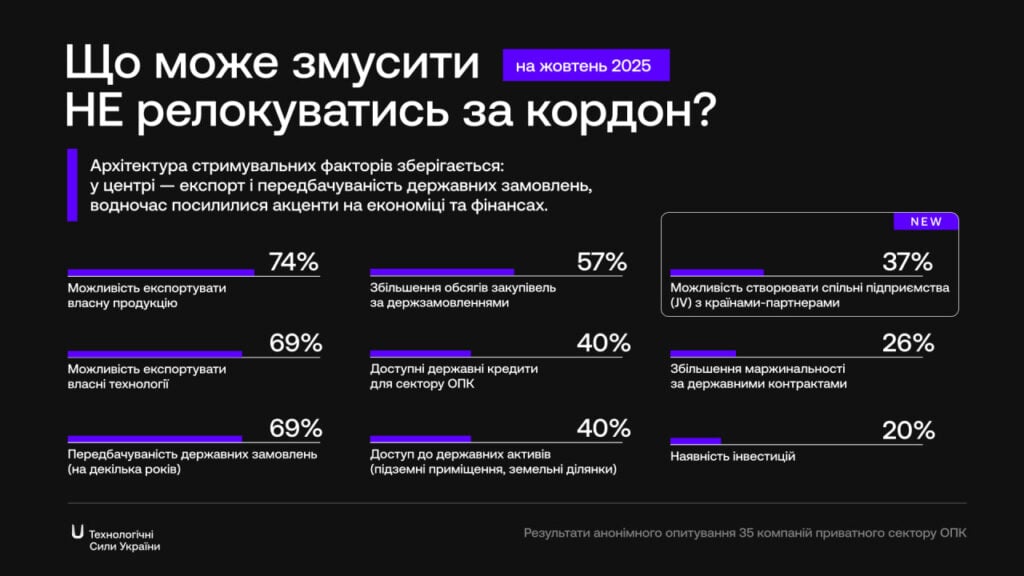

Manufacturers indicate the conditions under which they will stay in Ukraine:

- Ability to export products – 74%

- Possibility to export technologies – 69%

- Predictability of government orders – 69%

- Increase in public procurement – 57%

- Affordable loans for the defense industry – 40%

- Establishment of joint ventures with partners (JV) – 37%.

“The industry has positively perceived the green light from the state to open the export of weapons and military equipment. This is confirmed by another indicator of the survey: 56% of manufacturers see proactive steps by the state to improve the business climate in the defense sector, compared to 38% at the beginning of the year. This dynamic may continue in the next six months if the industry sees that the state has developed equal rules of the game for companies, clearly outlined red lines and adheres to European principles in the international arms trade,” says the TSU Executive Director.

Production utilization: alarming figures

Only 14% of companies expect their production capacities to be fully utilized in the next six months. Another 21% predict work at more than half of capacity. The majority again see only partial utilization.

TSU experts note that the opening of exports and JVs could provide work for enterprises, allowing them to fulfill international contracts.

What channels are used for procurement?

As of October 2025, the most common procurement channels are:

- Direct contracts with military units – 80%

- Closed procurements through the Healthcare Agency – 54%

- Procurement by communities – 46%

- International programs – 29%

- Joint ventures – 11%

- Prozorro / Prozorro Market – 6%

Bureaucracy remains a barrier

According to the survey:

- 48% of companies believe that bureaucratic obstacles in public procurement have decreased slightly

- 34% see no changes compared to 2024.

Read us on Telegram: important topics – without censorship