Retail Leader 2025: which supermarket made the most profit and why

27 October 14:04

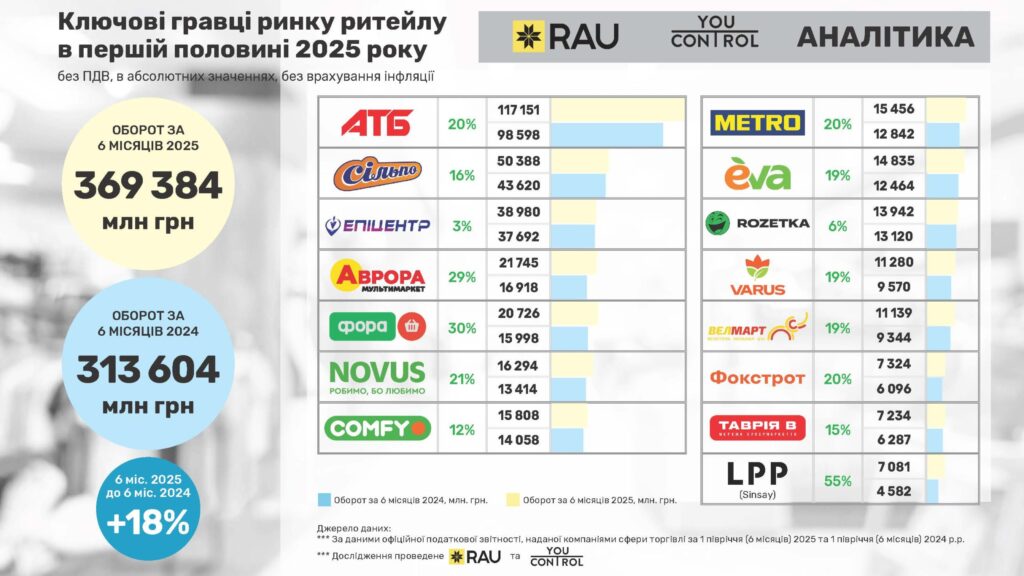

The first six months of 2025 were a turning point for Ukrainian retail. Despite the war, logistical challenges, and inflation, the industry is showing recovery and gradual growth. According to the Retail Association of Ukraine (RAU) in partnership with YouControl (YC.Market), retailers’ revenue reached UAH 936.6 billion, which is 17% more than in the first half of 2024, "Komersant Ukrainian" reports

However, given the high inflation (14.3% as of July), real growth is only 2.7%, which is almost in line with the Ministry of Economy’s forecast for GDP growth.

Key players in the retail market

If we single out the main players that contributed to the growth of Ukrainian trade, we can see that among the 15 companies whose turnover was among the largest, there are representatives of both food retail and non-food segment operators, sellers of clothing, appliances, building materials and other goods. And almost all of them are RAU members.

In total, these fifteen companies generated UAH 369.38 billion in turnover in the first half of 2025, which is 39% of total retail revenue.

Compared to the same figures of the previous year (UAH 313.6 billion), their turnover increased by 18%.

What influenced the market: inflation, consumer demand and prices

The main growth drivers were

- higher prices for raw foods (meat, fruit, berries) due to rising costs and prices in foreign markets

- increase in the cost of processed foods to 18.2%,

- strengthening consumer confidence amid an expected decline in inflation to 9.7% in 2025 (NBU forecast).

Retailers are actively investing in logistics, automation, and expansion of networks, both physical stores and online platforms.

Top market players: who earned the most

Among the 15 leading companies, which accumulated 39% of the total market revenue (UAH 369.38 billion), grocery chains hold the leading positions.

- ATB is the absolute leader

Revenue: uAH 117.15 billion.

Growth: 20%.

Employees: 59 000.

ATB continues to expand its network dynamically, focusing on low prices, its own brands and logistics infrastructure.

- “Silpo

Revenue: uAH 50.39 billion.

Growth: 16%.

The company focuses on the premium segment, the development of gastronomic spaces and service.

- “Fozzy Group

Revenue: uAH 20.73 billion.

Growth: 30% – the largest increase in the grocery segment.

Fora is actively developing the convenience format and introducing digital services.

- Avrora

Expanded its network to 145 stores.

The retailer is actively engaged in the low-cost household goods segment, competing with European chains.

- Sinsay (LPP, Poland)

Revenue growth: 55%, up to UAH 7 billion.

51 new stores in three months.

Sinsay holds a share of the clothing and household goods market, demonstrating the fastest growth rate among non-food retailers.

Who slowed down

Epicenter – 3%, which is explained by the high comparison base and the effects of Russian shelling: 10 shopping centers are temporarily out of operation in 2025.

Rozetka – up 6%, to almost UAH 14 billion: the online retailer is gradually regaining its position, but the pace is much slower compared to the grocery segment.

Read us on Telegram: important topics – without censorship