The NBU reduced foreign currency sales to $551 million: what it means for the hryvnia exchange rate

25 August 22:43

Last week (August 18-22, 2025), the National Bank of Ukraine (NBU) sold $551.15 million on the interbank market, while not buying foreign currency. This is reported by "Komersant Ukrainian", citing data from the national financial regulator.

According to the data, the NBU sold $551.15 million on the interbank market during the week, which is $56.65 million less than last week. At the same time, the National Bank did not buy any foreign currency during the week.

Economists and financial analysts explain that the NBU sold foreign currency primarily to maintain a stable hryvnia exchange rate and smooth out fluctuations.

The main goal of the NBU’s foreign exchange interventions is to avoid excessive exchange rate fluctuations and ensure financial stability. The regulator sells foreign currency from its international reserves to cover the structural shortage of foreign currency caused by the war. The large volumes of sales (such as $551 million in a week) are aimed at covering excess demand for foreign currency and preventing the hryvnia from weakening.

The reason for these large interventions was the significant excess demand for foreign currency from the market, especially from households. According to the NBU, during August 18-22, individuals bought more foreign currency than they sold every day, resulting in a negative balance of transactions by individuals. In particular, the net purchase/sale balance of households on those days was as follows:

- august 18 – $11.15 million

- august 19 – $12.85 million;

- august 20 – $15.94 million;

- august 21 – $16.35 million.

It can be seen that the net balance was negative on August 18-21, which means that the demand for foreign currency by the population was exceeding the supply.

The NBU compensated for this persistent excess of households’ demand for foreign currency by selling reserves to meet market needs and prevent devaluation pressure. The NBU intervened within the regime of “managed flexibility” of the exchange rate, and the regulator did not allow sharp jumps by entering the market on a spot basis.

As a result of this approach, the hryvnia has been kept in a relatively narrow range (in August, the official exchange rate fluctuated only between 41.72 and 41.86 UAH/$). The sale of foreign currency was aimed at smoothing out fluctuations and supporting a fixed/managed hryvnia exchange rate in the face of high demand, as well as maintaining macrofinancial stability.

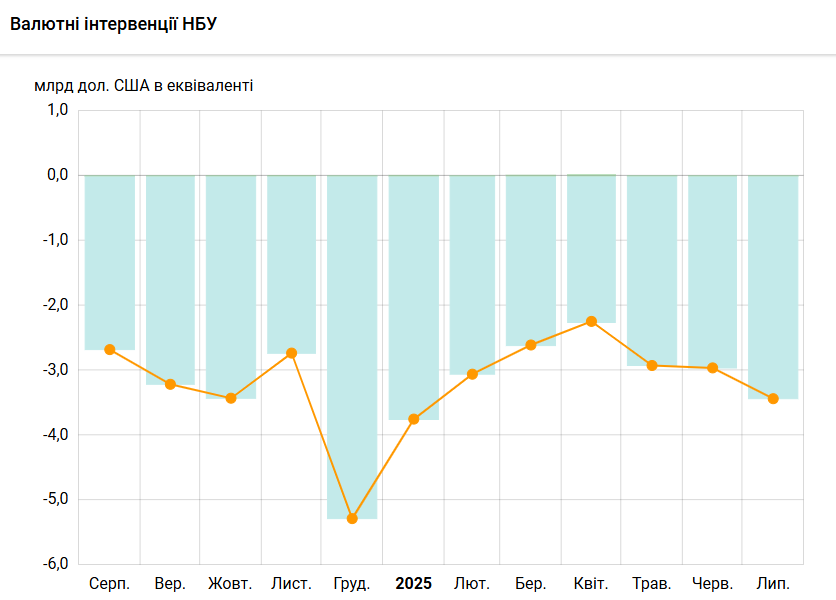

It is worth noting that since the beginning of 2025, the NBU has almost exclusively sold foreign currency, buying back minimal amounts. As of the end of August, the regulator had already sold about $22.77 billion on the interbank market, while it had bought only about $37.8 million.

Thus, the interventions are systemic and serve to cover the chronic shortage of foreign currency. This deficit is mostly covered by international assistance. And the NBU maintains market stability by compensating for the lack of foreign currency with proceeds from foreign partners.

According to the national financial regulator, the demand for foreign currency will remain high in 2026, but record levels of external financing will allow the NBU to meet this demand and even increase reserves (expected to reach $54 billion).

Read also: Big Mac index: the dollar exchange rate in Ukraine should be 22 hryvnia

Impact of interventions on the official hryvnia exchange rate

The NBU’s active sales of foreign currency during August 18-22 had a significant stabilizing effect on the hryvnia exchange rate. Despite the growing demand for foreign currency, the official hryvnia exchange rate did not weaken, but rather strengthened slightly. Over the week, the hryvnia strengthened by about 6 kopiykas against the US dollar (from UAH 41.34 to UAH 41.28 per $1) and by 37 kopiykas against the euro (from UAH 48.30 to UAH 47.91 per €1). In other words, the hryvnia exchange rate improved: the national currency became slightly stronger than it was at the beginning of the week. This indicates that the interventions have achieved their goal of supporting the hryvnia and preventing its depreciation.

Дивіться нас у YouTube: важливі теми – без цензури

The interbank market did not see any sharp exchange rate fluctuations that week. Average cash rates in banks changed little and remained close to the official rates (buying – $41.05, selling – $41.59 per $1 as of August 25).

There was no panic among the population. On the contrary, experts noted that the foreign exchange market is in a phase of relative calm (“calm”). A number of factors contributed to this stability. In particular, the absence of external shocks (a stable global backdrop) and the NBU’s dosed currency interventions, along with the gradual liberalization of rules. These steps by the regulator have kept market volatility and controllability low, meaning that the exchange rate moves smoothly and predictably. In fact, the NBU’s sale of foreign currency has met excessive demand and relieved pressure on the hryvnia, so there has been no shortage of foreign currency or a hype of the exchange rate. On the contrary, the market is balanced: the NBU’s supply of dollars fully met demand, which allowed the hryvnia to strengthen slightly against the dollar and the euro.

Overall, the official exchange rate remained stable within a narrow band in August, confirming the success of the NBU’s strategy. The regulator continues to adhere to its managed exchange rate policy, preventing sharp devaluation movements through interventions. The results of the week of August 18-22 showed that even with strong demand for the currency, timely interventions can smooth out fluctuations. The hryvnia exchange rate remained virtually unchanged or even strengthened, and there was no market panic.

Читайте нас у Telegram: головні новини коротко