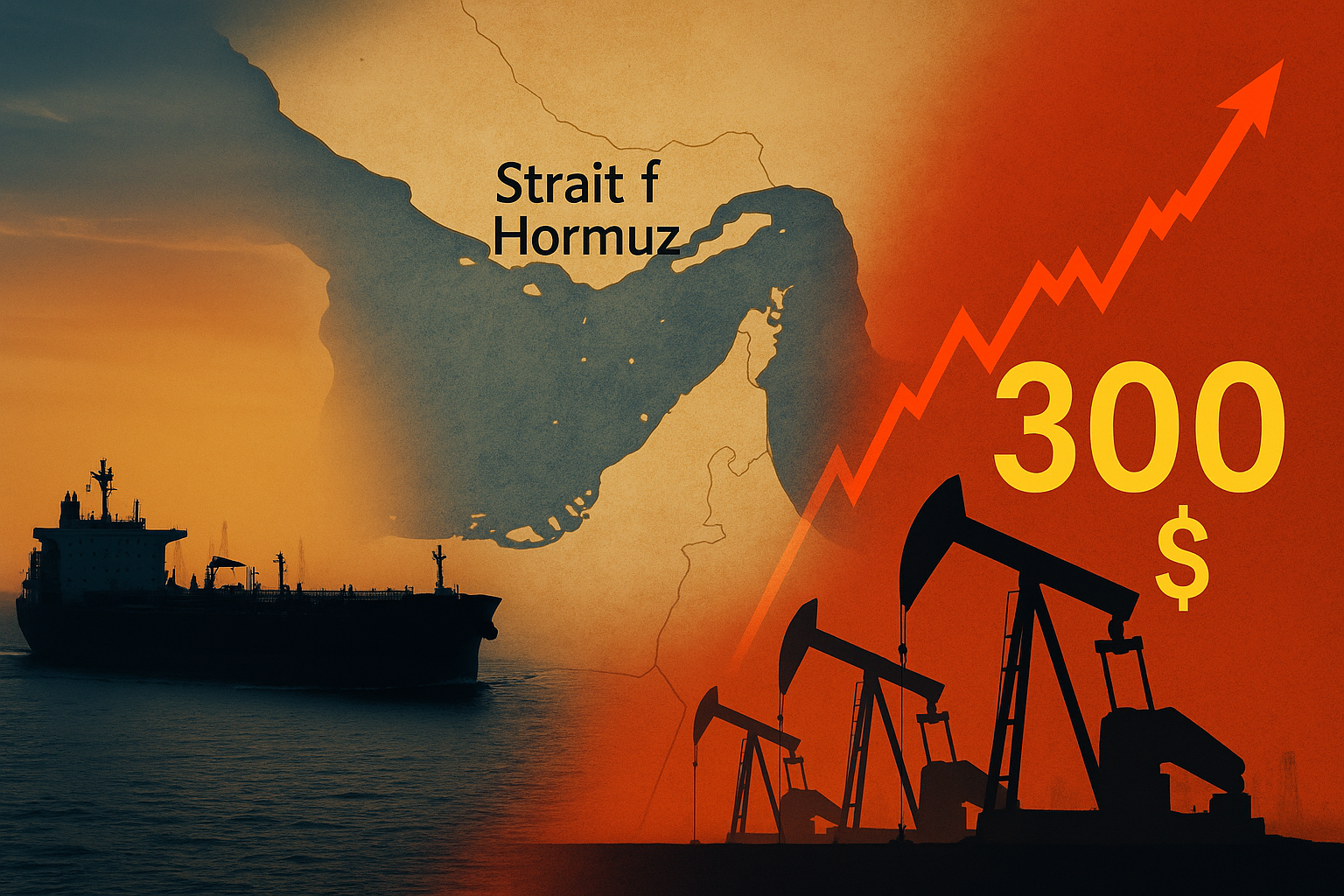

Blocking the Strait of Hormuz: will oil really be at $300 per barrel

23 June 14:48

Amid threats from Iran to block the Strait of Hormuz, one of the key oil transportation routes in the world, the media are reporting predictions of a possible rapid rise in oil prices. However, energy expert Mykhailo Gonchar in a commentary

On June 22, the Iranian parliament approved the closure of the Strait of Hormuz, which lies between Iran and the UAE. But the final decision must be made by the Supreme National Security Council.

Mykhailo Honchar in a commentary

“The realities are somewhat different. Of course, there will be a price jump, but so far there are no facts about the closure of the Strait of Hormuz, except for the decision of the Iranian parliament on this. But, given the complex and hierarchical decision-making system in Iran, the last word will be for the Rahbar, i.e. Ali Khamenei,” he explains.

According to Honchar, Iran is demonstrating a threat rather than actually preparing for a blockade of the strait.

“Iran is simply projecting a threat… But it will be quite difficult for it to do so, in particular because its own oil traffic also passes through the Strait of Hormuz,” he explains.

In addition, Iran is significantly influenced by China, which is the main importer of Iranian oil. And although China is not critically dependent on these supplies, their share in China’s energy balance remains important, the expert clarifies.

Gonchar also drew attention to an important geographical detail: most of the sea corridors pass through Omani territorial waters rather than Iranian ones.

“The Strait of Hormuz is not the Bosphorus. The narrowest part of the strait is about 55 km, the average is more than 90 km. It is physically much more difficult to block it than it may seem,” the expert emphasizes.

The expert recalled that even during the Iran-Iraq war, when the “tanker war” was going on in the Gulf of Hormuz, oil prices did not rise, but rather began to decline.

“That’s why the situation doesn’t look as clear-cut as it is written about, that ‘everything is lost,’ Iran cuts off the supply, and the price is 150, 300, or 350 dollars per barrel. You can fantasize about any topic, and this one in particular,” says Honchar.

Another factor of stability is the availability of alternative supply routes.

“Saudi Arabia has long taken care of transportation security. There is the Abqaiq-Yanbu oil pipeline, which brings oil to the Red Sea. It does not fully compensate for the volumes from the Persian Gulf, but it provides diversification,” the expert notes.

Although Iran may resort to targeted attacks, in particular on US ships in the Persian Gulf, Honchar predicts that these will be more symbolic actions. He sees the real risk in attempted terrorist attacks outside the Strait itself.

“Nervousness will undoubtedly affect the oil market. And on top of that, there is the unbridled desire of oil speculators. It’s an ideal situation for them to make money on this,” the expert concludes.

Despite the loud headlines, the real picture is more complicated and less dramatic. The market is likely to react with a short-term price spike, but a systemic energy crisis because of the Strait of Hormuz is unlikely,” Gonchar says.

The Strait of Hormuz is a narrow sea passage between the Persian Gulf and the Indian Ocean, which is of extreme strategic importance for global energy trade. It is approximately 160 kilometers long and only 21 kilometers wide at its narrowest point. The shipping channels are only 2 kilometers in each direction, making merchant ships particularly vulnerable to potential attacks due to their proximity to the coast.

Every day, about 16.5 million barrels of oil and condensate are transported through the Strait of Hormuz, in particular from key oil exporters such as Saudi Arabia, Iraq, Iran, Kuwait, and the United Arab Emirates.

In addition, up to 30% of the world’s liquefied natural gas supplies and up to 20% of global oil and oil products exports pass through this sea route. An important role is also played by Qatar, one of the largest LNG exporters, for which the Strait of Hormuz is the main logistics route.