The first auctions of November brought UAH 4.6 billion to the budget: which bonds are chosen by investors

5 November 09:57

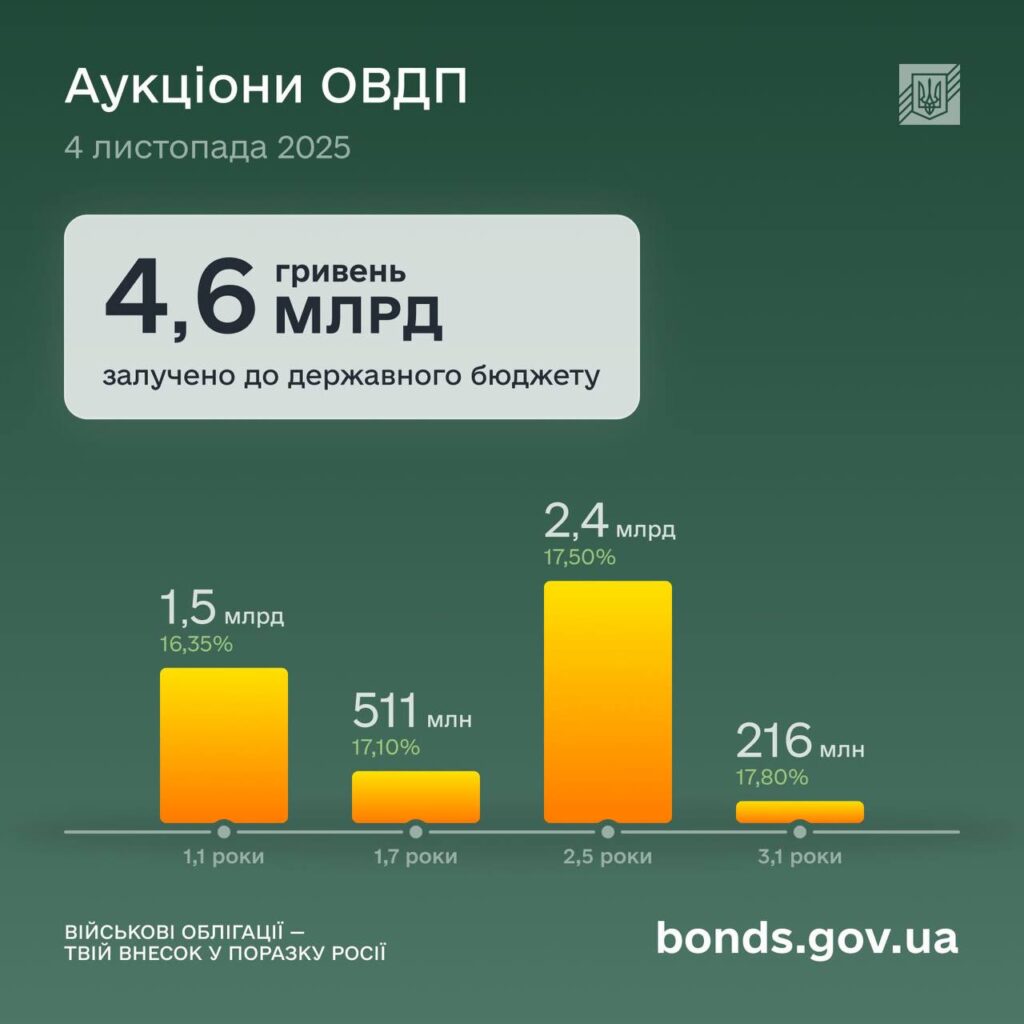

The first auctions of domestic government bonds held in November raised UAH 4.63 billion for the state budget. Despite a stable sales schedule, investors continue to actively buy Ukrainian securities – this time, the greatest interest was shown in long-term issues with a maturity of 2.5 years. This was reported by "Komersant Ukrainian" with reference to the press service of the Ministry of Finance of Ukraine.

Which securities brought in the most money

According to the Ministry of Finance, 2.5-year bonds were the leaders in demand, with a yield of 17.5% and a total of UAH 2.38 billion.

Shorter issues showed more modest results:

- 1.1 year (yield 16.35%) – UAH 1.52 billion was raised;

- 1.7 years (yield 17.1%) – another UAH 511 million.

In addition, the Ministry of Finance offered investors longer bonds for 3.1 years with a yield of 17.8%, which brought in UAH 216 million.

How the dynamics of placements are changing

Since the beginning of 2025, the Ministry of Finance has already raised UAH 477.7 billion through the placement of domestic government bonds.

And since the beginning of the full-scale war, the total amount of sales has exceeded UAH 1.89 trillion.

This demonstrates the stable confidence of investors, both domestic and international, in Ukraine’s government debt instruments.

What are domestic government bonds and why are they important?

Domestic government bonds (DGBs) are government securities issued by the Ministry of Finance to raise funds for the budget.

In fact, by purchasing government bonds, an investor lends money to the state, and the state guarantees to return the money with a profit within a certain period of time.

These securities are considered to be one of the safest financial instruments in Ukraine, as their repayment is guaranteed by the state.

In addition to hryvnia-denominated bonds, there are also foreign currency bonds denominated in dollars or euros. The face value of one bond is UAH 1000, $1000 or €1000.

Where the funds are directed

All funds raised through the sale of domestic government bonds are used to:

- support for the Armed Forces of Ukraine;

- financing critical budget expenditures;

- strengthening the financial stability of the state.

When auctions are held

Domestic government bond auctions are held every Tuesday, and the results are traditionally published by the Ministry of Finance on the same day.

This is a regular instrument for raising funds, which helps the state to keep the economic front even in difficult conditions of war.