Tobacco excise tax increase: what has changed for producers, sellers and consumers since March 25

26 March 13:58

Starting March 25, Ukraine will introduce new excise taxes on tobacco products and liquids used in e-cigarettes. This is reported by "Komersant Ukrainian" with reference to the State Tax Service.

On March 25, 2025, Law No. 4115-IX “On Amendments to the Tax Code of Ukraine and Other Laws on Revision of Excise Tax Rates on Tobacco Products” came into force in Ukraine. The document, published in the Golos Ukrainy newspaper No. 58 of March 25, introduces significant changes to the Tax Code and Law No. 3817, regulating excise taxes on tobacco and related processes. What will change for manufacturers, sellers and consumers? The Tax Service has explained all the innovations.

The law amended the following:

- The Tax Code of Ukraine;

- The Law of Ukraine No. 3817-IX dated 18.06.2024 “On State Regulation of Production and Turnover of Ethyl Alcohol, Alcohol Distillates, Bioethanol, Alcoholic Beverages, Tobacco Products, Tobacco Raw Materials, Liquids Used in Electronic Cigarettes and Fuel” (hereinafter – Law No. 3817).

Key amendments to the Tax Code of Ukraine

The new legislative provisions affect the excise policy, retail price formation and the introduction of new tax mechanisms. The main innovations include:

Retail price regulation

- Establishment of a maximum retail price for tobacco products.

- The minimum selling price cannot be lower than the excise duty multiplied by a coefficient of 1.45.

Introduction of a new term “non-alcoholic beer”

- A beverage with an alcohol content of up to 0.5% by volume.

- It is classified in the commodity category 2202 of the Ukrainian Classification of Goods for Foreign Economic Activity.

New mechanism for applying exchange rates

- The official NBU exchange rate as of the beginning of the first half of the year is used for excise tax payments.

- The rule applies to the purchase of excise stamps, the formation of a unique identifier and the declaration of tobacco products.

Reduction of permissible losses of raw materials

- The rate of losses in the production of fermented tobacco raw materials has been reduced from 10% to 5%.

Excise rates are set in euros

- The tax on tobacco, tobacco substitutes and cigarettes is calculated in the EU currency.

Annual excise tax increase until 2027

- The law provides for a gradual increase in rates until December 31, 2027.

Excise tax recalculation for producers and importers

- New procedure for determining the amount of taxes for companies supplying tobacco products to the market.

Changes in anti-forstallation restrictions

- During martial law, the average monthly sales volume of excise stamps is allowed to increase up to 120% (previously 115%).

Innovations in the production and circulation of tobacco products

The Law also amends the Law of Ukraine No. 3817-IX on the regulation of the production and sale of tobacco products:

The list of equipment subject to licensing has been expanded

- Machines for the production of cigarette filters and cartridges are included.

Tougher penalties

- Fines have been introduced for selling alcohol at reduced prices.

- Video surveillance at tobacco production facilities is now mandatory.

- The sale of excisable goods below the minimum prices is punishable by fines.

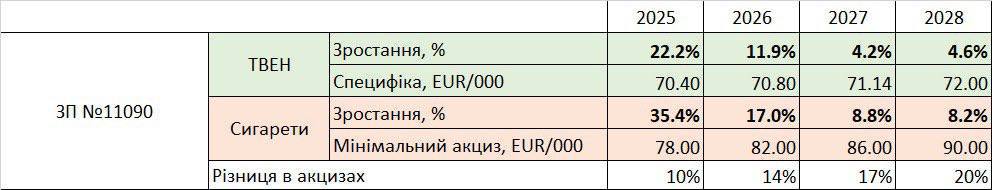

It should be noted that on March 24, President Volodymyr Zelenskyy signed Bill No. 11090 on increasing the excise tax on tobacco products, which had been expected since December 2024.

How much will cigarettes rise in price

According to the law, in 2025, the specific excise tax rate on cigarettes with and without a filter will increase by 23.4% – from 47 to 58 euros per 1000 pieces.

The minimum tax liability for excise tax will increase by 23.9% – from EUR 63.45 to EUR 78 per 1000 units.

In addition, the rates will be calculated in euros instead of hryvnia.

The document proposes to establish a gradual increase in excise tax rates on tobacco products in the following years.

In 2025, the excise tax will increase by 23%, and in 2026-2028 it will grow by 5% per year.

The cost of a pack of cigarettes is expected to increase to:

- uAH 127.4 in 2025

- 142.1 UAH in 2026;

- 155.8 UAH in 2027;

- 173.6 UAH in 2028.

It is expected that the implementation of the draft law will result in an increase in budget revenues in 2025 in the amount of about UAH 612 million, in 2026 – UAH 5 billion, in 2027 – UAH 9.3 billion, and in 2028 – UAH 13.8 billion.

This increase will lead to a significant rise in the price of cigarettes in the country – the price of a pack may exceed UAH 170 within four years.

Follow us on Telegram: the main news in a nutshell