Taxes, VAT, excise: what brought the state budget an extra 71 billion

1 September 18:47

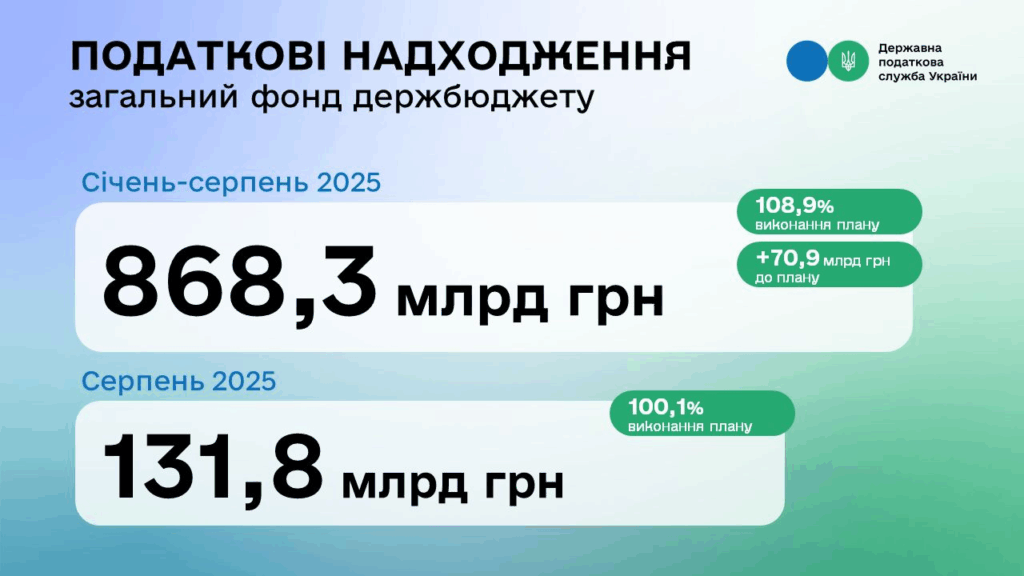

The State Tax Service of Ukraine (STS) has exceeded its budget revenues target by almost UAH 71 billion in the first 8 months of 2025 amid the war. This was reported on her official Facebook page by Lesia Karnaukh, who is temporarily acting as the head of the agency.

According to her, the plan was exceeded by 108.9%. In August alone, the overperformance was 100.1%.

Karnaukh emphasized that the general fund of the state budget has already received UAH 868.3 billion. This is UAH 173 billion more than in the same period last year, which corresponds to an increase of 24.9%.

I am grateful to every taxpayer – it is you who contribute to the stability of Ukraine every day,” the official wrote.

Details of the accumulation: August is a new barrier in the implementation of the plan

In August, the state budget received UAH 131.8 billion, which is UAH 29.8 billion more than in August 2024, an increase of 29.3%.

Revenues were distributed in the following categories:

- personal income tax (PIT) – UAH 30.7 billion

- corporate income tax – UAH 51.1 billion;

- VAT – UAH 38.0 billion;

- vAT refund – UAH 14.6 billion;

- excise tax – UAH 15.6 billion;

- rent payments – UAH 6.1 billion;

- other revenues – UAH 5.0 billion.

The distribution shows a steady growth of basic revenue items and their adequate administration.

Significance and consequences of overfulfillment of the “tax plan” for the budget of Ukraine

1. Fiscal airbag. The over-execution allows minimizing the risks of a budget deficit, especially in times of economic uncertainty. This makes it possible to finance the critical infrastructure, social and defense sectors more effectively.

2. A signal to taxpayers. The figures confirm the effective work of the State Tax Service, namely, improved administration, involvement in the legal economy and maintaining business confidence through dialogue and transparency.

3. The basis for budget revision. The high revenue dynamics opens up opportunities for revising the budget allocation, including support for the development of venture capital programs, small businesses and improving the services of government agencies.

Read also: Record growth in tax revenues: how much Ukrainians paid in 2024

A little earlier, the tax authorities reported that in January-July 2025, local budgets received almost UAH 25.5 billion in land payments, which is 15.9% more than in the same period last year – UAH 3.5 billion more. In 2024, about UAH 22 billion was collected over the same period.

The largest amount of money was received from taxpayers in Dnipropetrovs’k region – UAH 4.5 billion, Kyiv – UAH 3.7 billion, Odesa – UAH 2.2 billion, and Lviv – UAH 1.7 billion. These regions are once again becoming leaders in land payments, demonstrating economic resilience and active land users.

Improved macro-financial indicators, stabilization in agriculture, and infrastructure development encourage owners and tenants to pay taxes, including land taxes, more actively. The State Tax Service is increasing control over the sources of income of individuals and legal entities, introducing digital tools to simplify the submission of documents, which increases transparency and reduces opportunities for evasion. Landowners are obliged to pay from the date of registration of ownership or use. In the event of termination of rights, pro rata payments are made for the actual period of use. This incentivizes the maintenance of complete documentation on the status of land, and the state receives a fair remuneration for the use of land resources.

Дивіться нас у YouTube: важливі теми – без цензури

Land payments are a key component of local budget revenues. It provides funding for social infrastructure, road maintenance, education and healthcare on the ground. Revenues have increased by tens of percent even during the war, which demonstrates the efficiency of the tax system and the resilience of local communities. In the leading regions of Dnipro, Kyiv, Odesa, and Lviv, these funds can be used for long-term projects such as school reconstruction, water supply modernization, and logistics infrastructure development.

Читайте нас у Telegram: головні новини коротко