“Google tax”: Ukraine’s budget revenues in 2025 break records

26 May 14:09

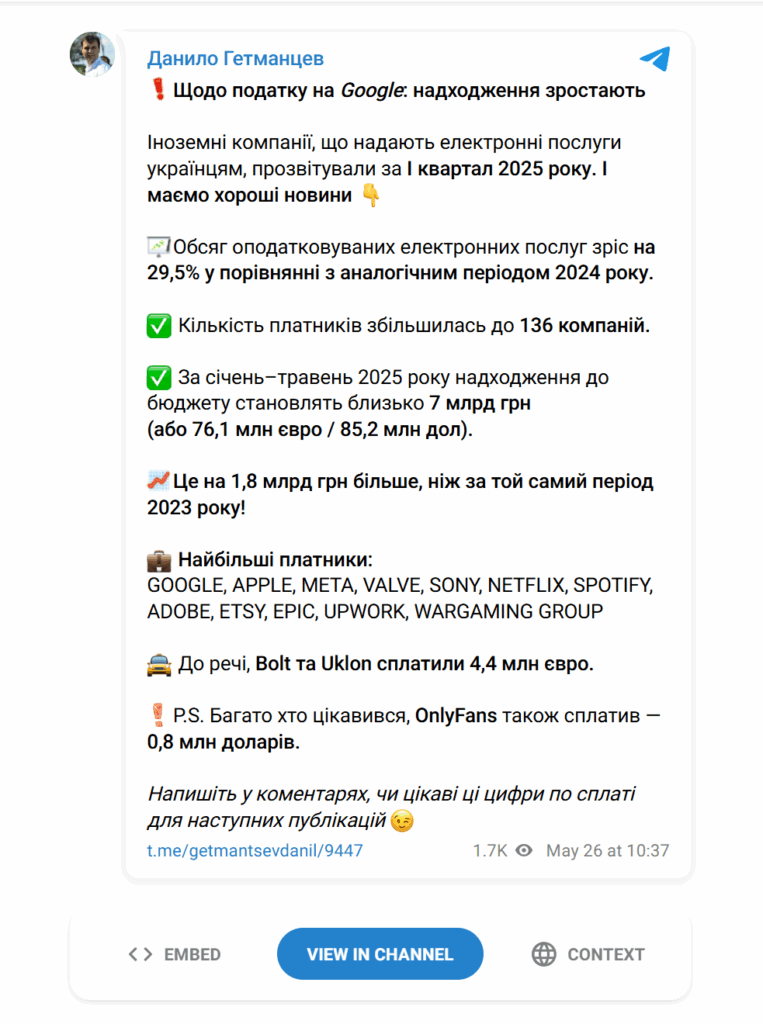

In 2025, Ukraine continues to successfully implement the so-called “Google tax”, which obliges foreign companies providing electronic services to Ukrainian consumers to pay 20% VAT. In the first five months of 2025, revenues from this tax amounted to about UAH 7 billion, which is UAH 1.8 billion more than in the same period in 2023. This is reported by "Komersant Ukrainian", citing a statement by Danylo Hetmantsev, chairman of the parliamentary committee on finance.

According to Mr. Hetmantsev, the figures show a positive trend.

“The volume of taxable electronic services increased by 29.5% compared to the same period in 2024. The number of taxpayers has also increased – now there are 136 companies,” Hetmantsev said in his telegram channel.

The total amount of budget revenues in January-May 2025 amounted to about UAH 7 billion. This is UAH 1.8 billion more than in the same period last year.

Who pays the e-services tax?

The companies that pay the tax in Ukraine include global giants whose services are used by millions of Ukrainians every day. The list of the largest payers includes:

- Apple

- Meta

- Valve

- Sony

- Netflix

- Spotify

- Adobe

- Etsy

- Epic Games

- Upwork

- Wargaming Group

Getmantsev also drew attention to taxi services:

“By the way, Bolt and Uklon paid 4.4 million euros,” he said.

The MP adds with humor:

“Many people were interested – OnlyFans also paid. The amount is 0.8 million dollars.”

What is known about the “Google tax”

the “Google tax” is a 20% VAT that large multinational corporations not registered in Ukraine must pay on revenues from the sale of electronic services: books, movies, games, cloud storage, software, advertising, etc.

The tax was introduced in June 2021, and the law came into force on January 1, 2022. The innovation was actively criticized, as, for example, Apple said it would increase the cost of services for Ukrainian users.

The need to introduce the “Google tax” is argued by the fact that the activities of technology corporations were carried out without proper taxation, which led to losses to the state budget and created an uncompetitive environment for resident taxpayers