Doubling of fees from individual entrepreneurs: economist explains why tax revenues have not actually increased

7 November 16:09 COMMENT

COMMENT

The real situation with the growth of the amount of taxes paid by individual entrepreneurs in the first 9 months of 2025 differs from the official statistics published by Opendatabot. Ihor Garbaruk, an international expert, economist, and member of the Economic Discussion Club, explained why this happened, "Komersant Ukrainian" reports.

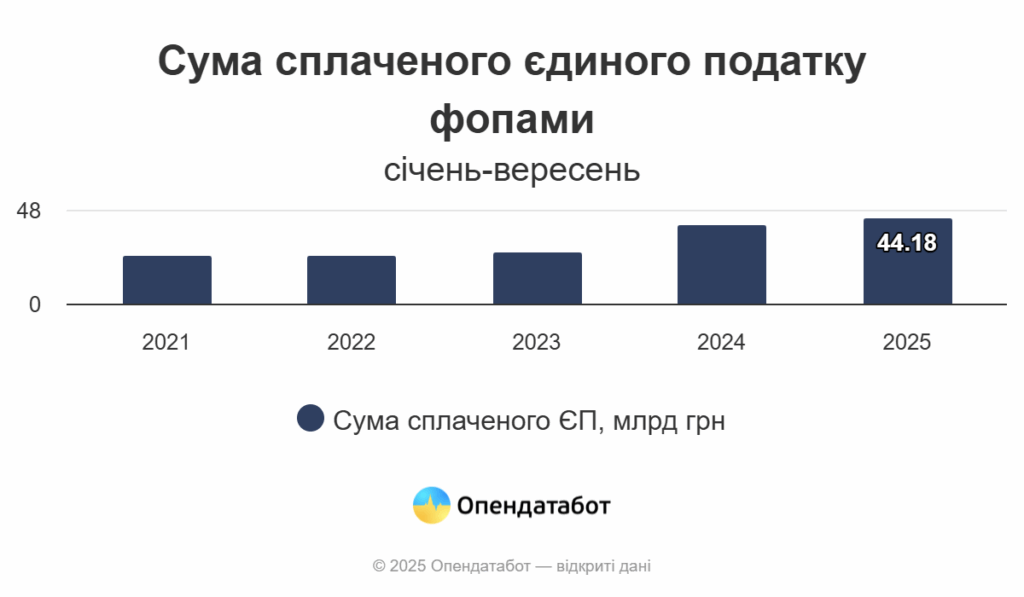

As a reminder, on November 6, the company released analytical data showing that individual entrepreneurs have already paid UAH 44.18 billion in single tax. Opendatabot emphasized that this is 10% more than last year and almost twice as much as in 2021 – before the full-scale invasion.

However, Ihor Garbaruk pointed out significant nuances. The economist explained that as of September 2025, the inflation rate (annualized) in Ukraine was 11.9%. Accordingly, the announced 10% increase in tax payments is even less than the official inflation rate.

The expert also commented on the statement that the growth in tax payments by individual entrepreneurs was twice as high as in 2022.

“The significant increase in tax payments is due not so much to an increase in tax payments as to a real increase in unsecured money supply in circulation and actual, not ‘officially declared’, inflation in 2021-2025,” Garbaruk explained.

The expert gave specific examples to support his opinion. Thus, the average cost of a kilogram of potatoes in Ukraine in September 2021 ranged from UAH 6.5 to 6.7. In the same period of 2025, it was already about UAH 17 per kilogram of vegetable. At the same time, according to the economist, the real price in Kyiv amounted to 25.0 UAH per kilogram of root crop.

A similar situation occurred in the fruit market. The average price for apples in July 2021 was 21.4 UAH per kilogram, and in July 2025, Ukrainians bought the popular fruit for 79.49 UAH.

Read also: Taxes, excise taxes, grants: how the state budget was filled in October 2025

Single tax from individual entrepreneurs: what 9 months of 2025 showed

Opendatabot presented information using infographics that in January-September 2025, individual entrepreneurs paid UAH 44.18 billion of the single tax. Thus, as of the end of the third quarter, 76% of the annual revenue plan was fulfilled.

Revenues were relatively flat throughout the year with a peak in the first quarter:

- Q1: UAH 15.77 billion;

- Q2: UAH 13.69 billion;

- Q3: UAH 14.71 billion.

This profile reflects a combination of seasonality in business activity, the effects of tax discipline at the start of the year, and entrepreneurs’ adaptation to market conditions in the summer.

However, economists warn that despite 76% of the plan being fulfilled after three quarters, the fourth quarter is traditionally characterized by increased uncertainty:

- seasonal spending by businesses and consumers may reduce free cash flow for private entrepreneurs;

- winter energy risks can locally “extinguish” business activity;

- the migration of workers and entrepreneurs between regions sometimes causes short-term gaps in payments.

On the other hand, the festive season supports the trade and services sector, which traditionally helps to boost targets in December.

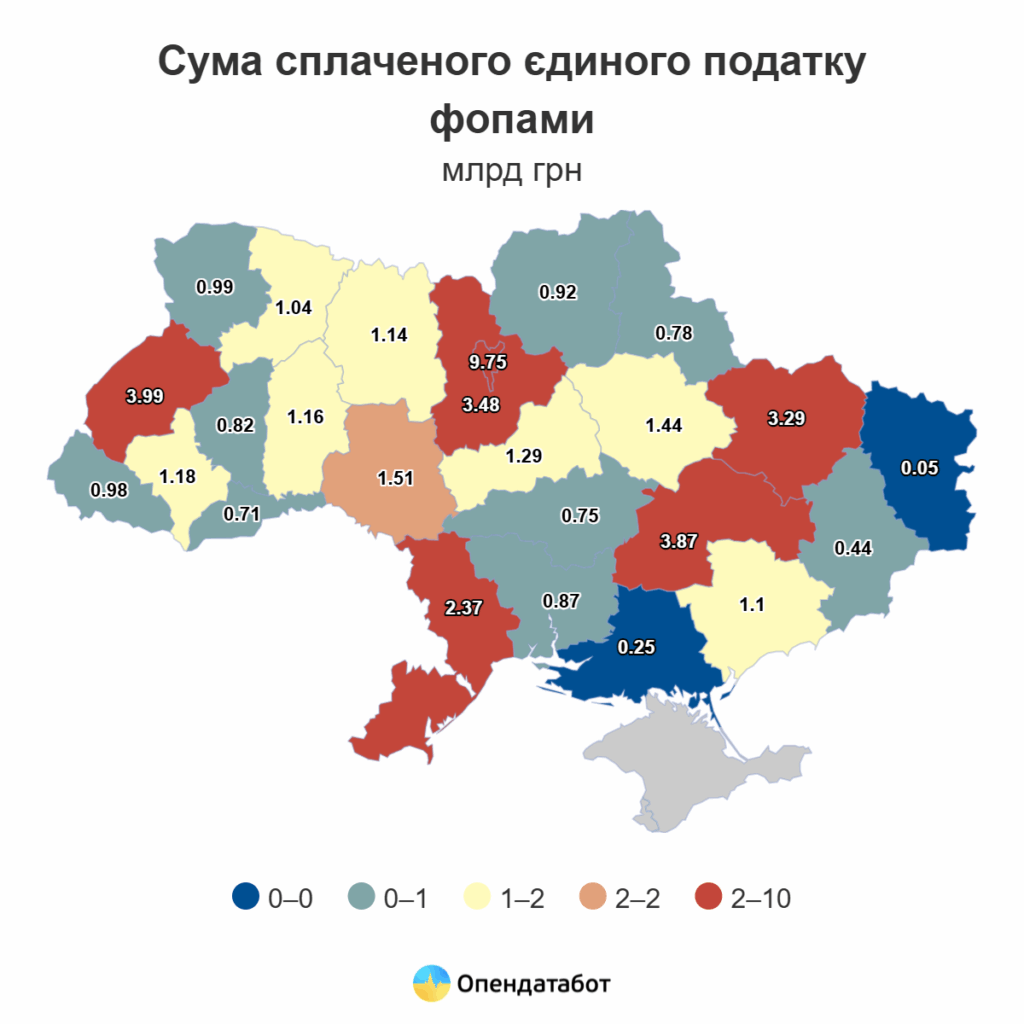

According to the results of the first nine months of 2025, Kyiv traditionally provided the largest single tax revenues – UAH 9.75 billion, which is about 22% of all payments in the country. The capital holds the lead due to the high concentration of small businesses in the services, IT and creative industries, where the simplified taxation system prevails.

Lviv region is in second place with UAH 3.99 billion, followed by Dnipropetrovs’k (UAH 3.87 billion), Odesa (UAH 2.37 billion), and Kharkiv (UAH 3.29 billion). Together, these five regions account for more than half of all single tax revenues in Ukraine.

The central regions also show positive dynamics:

- Poltava region paid UAH 1.44 billion;

- Cherkasy region – UAH 1.29 billion;

- Kirovohrad region – UAH 0.75 billion.

Despite the absence of large cities with a population of over a million, these regions maintain stable performance due to the development of agribusiness, logistics companies, and small-scale production.

The western regions show the highest growth rates. In Chernivtsi region, revenues from individual entrepreneurs increased by 15% to UAH 0.71 billion, while in Rivne, Volyn, and Ternopil regions, the growth was 12-14%. Economic activity there increased due to the relocation of businesses from the frontline areas and the development of domestic tourism.

Despite the constant security threats, Kharkiv region retains the fourth place among the regions with a result of UAH 3.29 billion. In the South, Mykolaiv region paid UAH 0.87 billion and Kherson region paid UAH 0.25 billion, which indicates a gradual recovery of economic activity in the difficult conditions of martial law.

In Zhytomyr region, individual entrepreneurs transferred UAH 1.14 billion, in Sumy region – UAH 0.78 billion, and Chernihiv region provided UAH 0.92 billion. These regions are recovering from the losses of 2022, maintaining their focus on the local market and the service sector.

Watch us on YouTube: important topics – without censorship

The unified tax is one of the key sources of local budget revenues, and its steady growth provides communities with resources to finance education, healthcare, municipal infrastructure, and security needs. In a number of regions, the share of the single tax in the structure of local budget revenues exceeds 10%.

According to analysts, the dynamics of tax payments indicates the recovery of small businesses after the military upheaval and confirms the resilience of Ukrainian entrepreneurs who have adapted to the new conditions and continue to form the basis of regional economies.

At the same time, according to Opendatabot statistics, the number of registered sole proprietorships remained almost unchanged over the year (0.75% by 2024), but the base is about 10% wider than before the war. In other words, the increase in revenues is due not only to the number of taxpayers, but also to the stabilization of small business turnover and partly to a return to normal tax behavior after the shocks of 2022.

Read us on Telegram: important topics – without censorship