Rent is falling, dependence is growing: what the map of business resource payments shows

17 February 20:08

In 2025, Ukrainian businesses paid nearly UAH 93 billion in resource payments for subsoil, land, and the environment. The amount has remained virtually unchanged, but its significance for the budget is declining. The state is increasingly dependent on a limited number of large extractive companies, while the decline in rent is only partially offset by an increase in land taxes.

This is according to a joint study by KNEU professor Roman Kornilyuk and the YouControl R&D center in collaboration with the Open Data Association, reports "Komersant Ukrainian".

What the study shows

A joint study by KNEU professor Roman Kornilyuk and the YouControl R&D center, in collaboration with the Open Data Association, notes a key shift: resource payments are no longer growing in line with the budget.

In 2025, they amounted to UAH 92.7 billion — only 0.9% more than a year earlier. For comparison, consolidated budget revenues for the same period grew by more than 20%.

This means that the role of payments for the use of natural resources in public finances is gradually weakening.

Gas remains the main contributor — but is also losing ground

Gas production remains the largest source of resource revenues: 44 companies accounted for more than a third of all payments. However, rent payments for gas fell by more than 10%.

The decline was even more pronounced in the oil and coal segments. Revenues from coal mining decreased by more than a third, highlighting the crisis in the industry amid the war and destruction of infrastructure.

The decline is partly explained by changes in the tax regime, in particular the emergence of a separate “natural resource asset” with preferential rates.

Read us on Telegram: important topics – without censorship

Land and ecology — new compensators for losses

Against the backdrop of declining rents, land payments are rising: land tax and rent have increased at double-digit rates. Environmental payments have also risen moderately.

However, these sources do not offset the decline in revenues from subsoil use. Total rent for subsoil use in 2025 decreased by more than 8%.

The budget depends on several dozen companies

The study shows a high concentration: about 65% of all resource payments are provided by only 20 companies.

These include the state-owned giants Ukrgazvydobuvannya and Ukrnafta, as well as major players in the mining and metallurgical complex, in particular the Metinvest Group and ArcelorMittal Kryvyi Rih.

Such concentration means high fiscal risks: problems faced by one large payer can have a significant effect on state and local budgets.

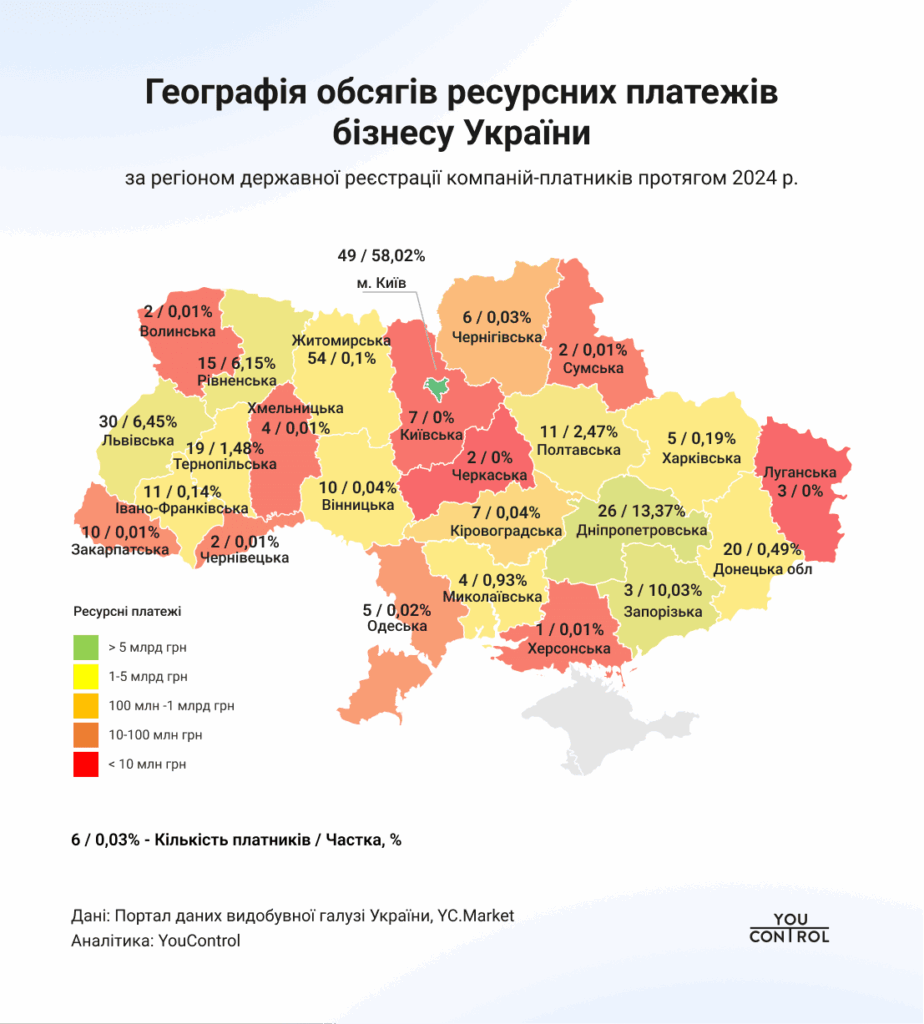

Kyiv collects money, regions extract resources

Almost 60% of all resource payments are accumulated in Kyiv due to the registration of companies’ head offices. Actual extraction, however, takes place in the Poltava, Kharkiv, Dnipropetrovsk, Zaporizhzhia, and western regions.

This again raises the issue of territorial justice: regions that bear the environmental and infrastructural risks of extraction do not always receive proportional budgetary benefits.

The authors of the study emphasize that tax discipline in resource payments is becoming a key ESG indicator. Systematic underpayments or debts on environmental taxes signal not only financial problems for companies, but also risks for communities, the environment, and potential investors.

In a war economy, where the budget is increasingly dependent on the stability of large taxpayers, transparency and control over resource payments are of strategic importance.

Watch us on YouTube: important topics – without censorship