How much tax should TikTok bloggers pay: a detailed analysis with an example

20 November 04:15

As part of the new “Taxes Protect” campaign, the Ministry of Finance and the State Tax Service explained how TikTok bloggers’ income is taxed and why legalization of income is important not only for the state but also for the creators themselves, "Komersant Ukrainian" reports

The Ministry of Finance and the State Tax Service have launched a new information campaign called “Taxes Protect,” which aims to explain to Ukrainians in simple terms what taxes they need to pay and in what situations. Over the course of three months, the project will publish infographics and videos with the most common cases related to citizens’ income, taxation, and the importance of tax discipline.

The series of materials will explain

- what taxes arise in everyday financial situations;

- how to pay them correctly and in due time;

- how funds are distributed between the state and local budgets;

- what exactly the state spends taxes on;

- what consequences can result from non-payment of taxes.

How much tax should a TikTok blogger pay?

The first feature story is dedicated to bloggers on social media.

The example is 22-year-old Maria, who runs a popular TikTok blog and advertises Ukrainian and foreign brands. Her average income is 60 thousand UAH per month (180 thousand UAH per quarter or 720 thousand UAH per year).

To work legally, Maria registered as a Group 3 individual entrepreneur, which allows her to:

- officially provide advertising services;

- receive payments from Ukrainian and foreign companies;

- use the simplified taxation system.

Every quarter, she submits a declaration through the My Tax app and pays the necessary taxes and unified social tax. As a result, a clear and transparent amount of mandatory payments is formed for the year.

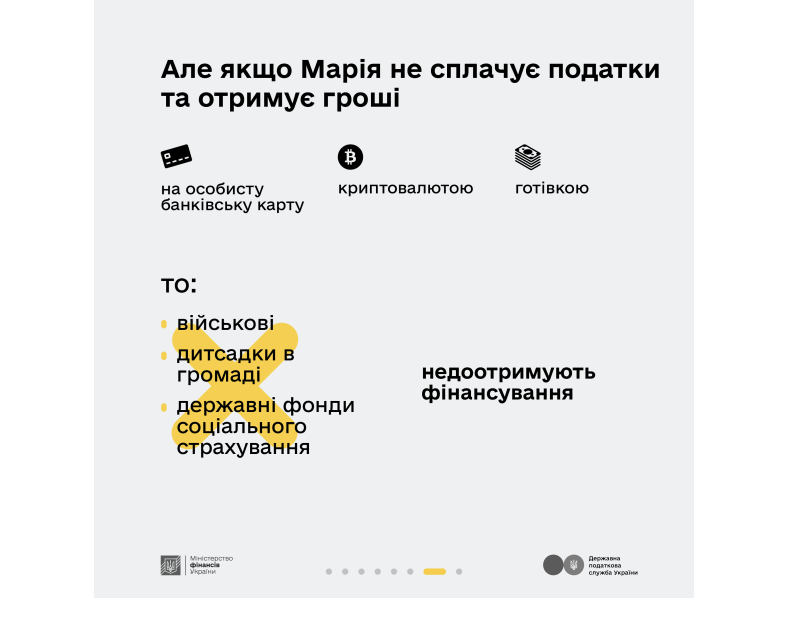

What happens if a blogger does not pay taxes

The campaign also emphasizes that receiving remuneration on a personal card, in cryptocurrency, or in cash without declaring it is not only a violation of the law, but also a direct loss for the state.

In this case:

- the army will not receive enough money to purchase high-quality turnstiles and other necessary equipment;

- kindergartens will not be able to update their equipment, for example, to replace old refrigerators;

- state social funds will receive less revenue, which means that the blogger himself may be left without social benefits if necessary.

The campaign aims to show that paying taxes is not a formality, but a contribution to security, social guarantees and development of the country.