The big fall: markets’ reaction to Trump’s new tariffs

3 April 09:30

Global markets have reacted negatively to the customs tariffs imposed by the United States yesterday, "Komersant Ukrainian" reports.

The tariffs

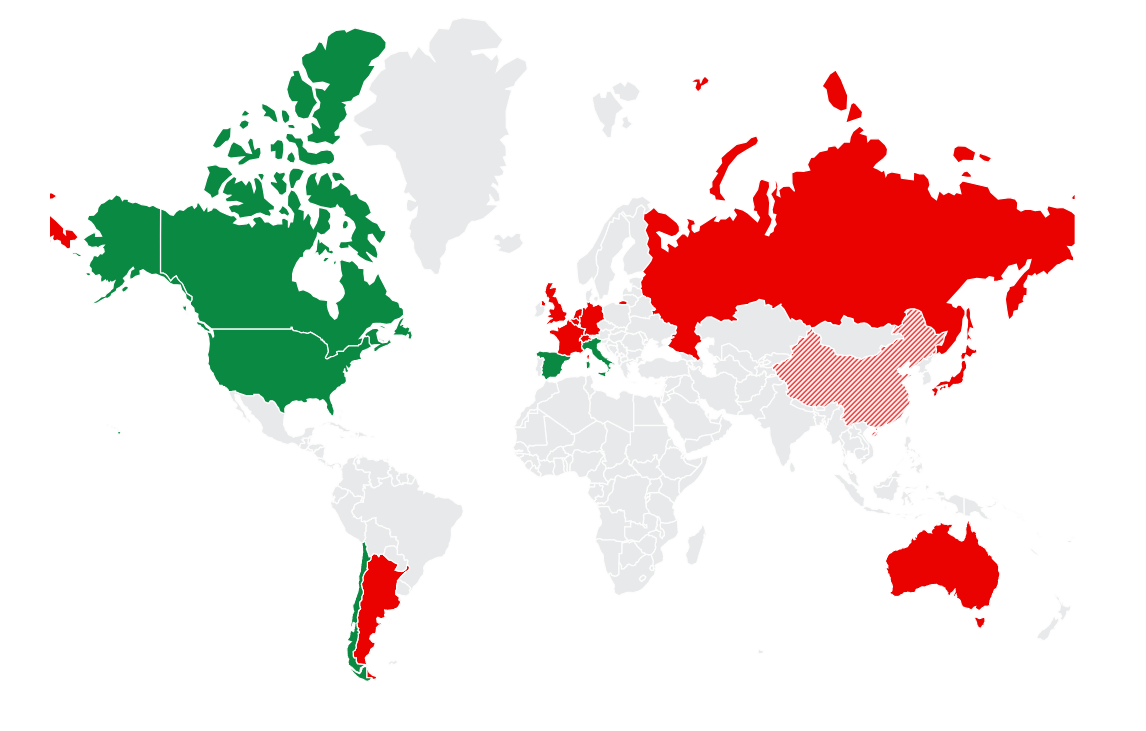

on April 2, US President Donald Trump announced the introduction of “mirror” tariffs against almost all countries except Russia. These tariffs, according to the White House, will be half of the tariff that a particular country has imposed on US goods. For example, China allegedly imposes a 67% tariff on US goods, so the US imposed a 34% tariff on Chinese goods.

For those countries that do not impose special duties on American goods, a basic tariff of 10% was introduced.

Interestingly, the comparative table released by the White House provides data on tariffs against 185 countries, but Russia is not on the list.

Trump called the introduction of such trade barriers “Liberation Day” and said that this day will go down in US history as the beginning of the restoration of the American economy and greatness.

Market reaction

The reaction of global markets to such an unprecedented step was not delayed. As the total US tariff on goods from China reached a staggering 54%, it immediately hit the shares of those tech giants with production centers in China and Taiwan. Apple was the hardest hit, as it still manufactures its iPhones in China – its shares fell by a fantastic 7%.

Nasdaq futures fell by 3.3%, S&P 500 by 2.7%, FTSE by 1.6%, and European futures fell by almost 2%.

The entire “Magnificent Seven” of American tech giants (Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla) lost about $760 billion in value at once.

Japan’s Nikkei fell by 2.8% after the previous drop to a minimum of eight months, with almost every index member falling.

Gold hit a record high of $3,160 per ounce.

Hong Kong’s Hang Seng index was down 1.6%, while South Korea’s Kospi fell 2%. Van Eck’s Vietnam ETF fell more than 8% in after-hours trading. Australian shares .AXJO fell by 2%. Markets in Taiwan were closed altogether.

The Chinese yuan fell to its lowest level since February 13 on the domestic market at 7.3060 per dollar.

Ten-year Japanese government bond futures made their sharpest jump in eight months.

Читайте нас у Telegram: головні новини коротко

Oil market

Imports of oil, gas, and refined products were exempted from Trump’s new tariffs. This allowed US refiners to breathe a sigh of relief, but did not save global oil markets from falling.

Brent futures fell by $1.60, or 2.13%, to $73.35 per barrel by 05:31 Kyiv time after falling 3.2% earlier, the largest daily percentage drop since March 5. Futures for US West Texas Intermediate crude fell $1.62, or 2.26%, to $70.09 after falling 3.4% earlier.

Market experts’ comments

The markets finally got the long-awaited “clarity” on Trump’s tariffs, but they didn’t like it.

“The tariffs are comprehensive and much higher than we expected. Earlier, people were talking about whether clarity would help the market. But now we have clarity, and no one likes what they see,”

– said Jeanette Gerratti, chief economist at Robertson Stephens, a consulting firm based in the US technology center of Menlo Park, California.

Most experts say that Trump’s move is an extremely powerful blow to global trade.

“The tariffs announced today pose a significant risk to global trade. Supply chains in East Asia are under particular pressure,”

– said Zhiwei Zhang, chief economist at Pinpoint Asset Management in Hong Kong.

However, tariffs never work one way. It is expected that the US trading partners will respond with their own countermeasures.

“Tariff rates are well above baseline expectations, and if they are not immediately reduced, expectations of a US recession will rise sharply,”

– said Tony Sycamore, market analyst at IG.

Читайте нас у Telegram: головні новини коротко