War for a kilowatt-hour: how systematic shelling is changing Ukraine’s economy

28 October 22:06 INFOGRAPHICS

INFOGRAPHICS

Electricity production in Ukraine has fallen to a new low: from 156.6 billion kWh in 2021 to 101.1 billion kWh in 2024. This is a drop of almost a third, according to an infographic by the Top Lead agency, "Komersant Ukrainian" reports.

After a sharp decline in 2022 (-27.5% compared to 2021), the rate of decline slowed: in 2023, production decreased by another 6.8%, and in 2024 – by 4.4%. There is no official public statistics on the generation structure for 2024, but the trend is obvious: the system operates with lower volumes and under constant risks for generating facilities and grids.

Structurally, the balance was shifting in 2021-2023. The share of nuclear generation decreased from 55% in 2021-2022 to 49% in 2023, reflecting the loss of capacity and restrictions on the operation of nuclear power plants. The share of TPPs/CHPs and block power plants fluctuated around 27-30%, but it was thermal generation that took over peak loads and balanced the system.

Hydropower and renewables gradually increased their contribution: hydro – from 7% to 12% in 2023, renewables – from 8% to 10%. At the same time, even the combined growth of these segments did not compensate for the overall decline in generation.

Reasons for the decline in electricity production in Ukraine

Energy experts name several factors at once.

These include large-scale damage to generating facilities and grids due to shelling, restrictions in the fuel logistics of thermal generation, poor hydrology in some seasons, and forced restrictions on renewables due to a shortage of flexible capacity and storage. This is compounded by a decline in industrial demand, population migration, and energy-saving behavior of households and businesses.

The economic consequences are tangible: lower domestic production means limited capacity reserves during peak demand, increased dependence on imported electricity from EU power systems, and volatility in wholesale prices. For industrial consumers, this means the risk of rising costs and the need for active demand management, while for households it means the possibility of tighter consumption schedules during periods of shortage.

Changes in the energy balance: how the market should respond

The key priorities are obvious:

- rapid restoration and modernization of damaged generating facilities and grids;

- development of flexible capacities (gas reciprocating and shunting units); scaling up energy storage and demand response systems; accelerating the development of distributed renewables with storage;

- preparing the nuclear fleet for long-term operation under life extension programs.

At the same time, regulatory incentives are needed: a transparent mechanism for paying for reserves, long-term investment signals for maneuverability, tariffs that reflect the daily structure of the deficit, and guarantees for private investment in distributed generation.

For now, the energy system is still holding together, but it is operating at a breaking point. Without accelerated investment in flexibility and infrastructure rebuilding, the decline in production could be prolonged, and the economy will pay for it in higher energy prices and lost output.

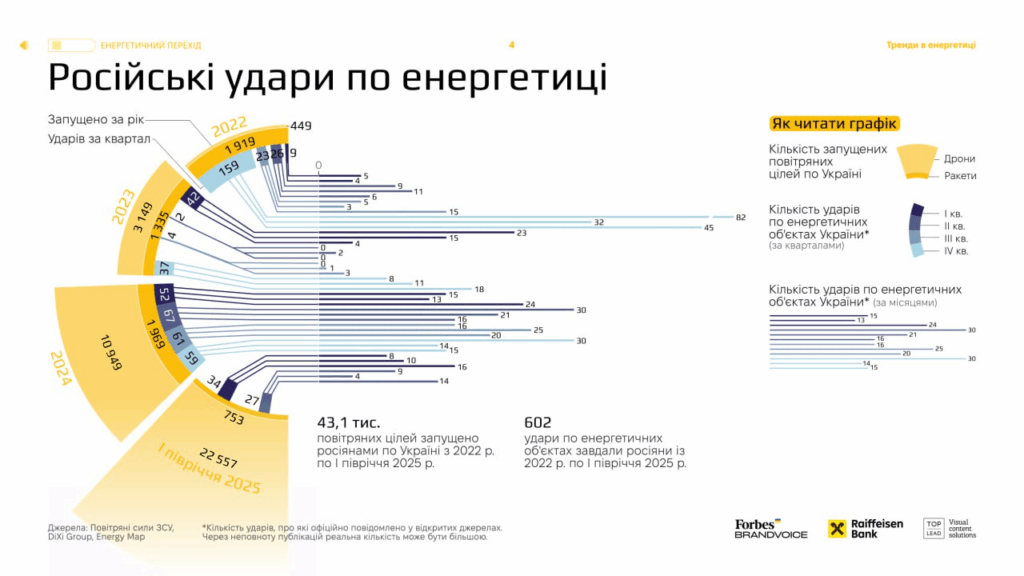

Energy infrastructure is under fire: Russia fired 43 thousand missiles and drones at Ukraine

Between 2022 and the first half of 2025, Russia carried out 602 targeted strikes on Ukraine’s energy facilities and launched at least 43.1 thousand air targets at our territory, according to the Top Lead visual communications agency.

According to the agency, the massive waves of strikes occurred during the so-called “energy season.” The first campaign peaked at the end of 2022. It was the fourth quarter that yielded a record number of hits on generation and network infrastructure. Later, the attacks became serial: in 2023, the monthly values ranged from dozens to thirty attacks, forming a “saw” of constant depletion.

In 2024, the structure of threats changed: the share of drones in the total flow of targets increased, and periods of massive launches became more frequent, albeit shorter. The first half of 2025 again showed high volumes of launches, which confirms the long war of attrition against the energy system.

Watch us on YouTube: important topics – without censorship

What exactly was hit by the Russian Armed Forces

Both generation facilities (thermal power plants, hydroelectric power plants, substations) and electricity transmission hubs were targeted. The logic of the attacks is simple: less available maneuvering and reserve capacities, greater deficits during peaks, more expensive balancing electricity, and greater dependence on imports from ENTSO-E. Each successful attack is multiplied by the costs of repairs, mobile transformers, shunting units, fuel logistics, and insurance premiums.

For industry, this means the risk of forced downtime and higher product prices due to volatile wholesale prices and restriction schedules. For households, it means higher bills during peaks and the likelihood of localized outages during new waves. For the state – systemic CAPEX to restore generation and grids, deploy energy defense and purchase imports during shortage hours.

Read us on Telegram: important topics – without censorship