How the EU continues to finance the Russian war machine – analysis

11 September 11:07

Despite numerous sanctions packages and rhetoric about supporting Ukraine, the European Union remains one of the largest buyers of Russian fossil fuels. In August 2025 alone, the five largest EU importing countries paid 979 million euros to Russia for gas, oil, and coal. This is evidenced by a new study by the Center for Research on Energy and Clean Air (CREA), "Komersant Ukrainian" reports.

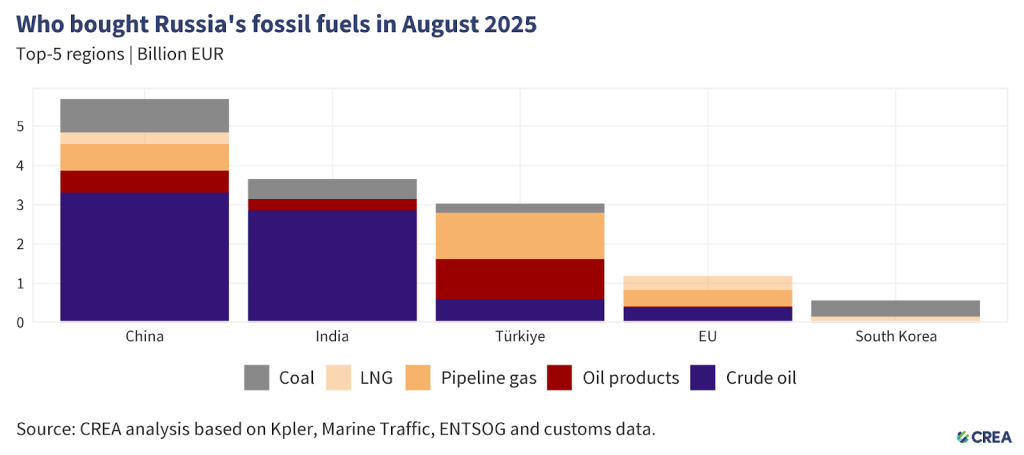

The EU ranks fourth in the world

In the global ranking of buyers of Russian fuel, the European Union ranks fourth with total purchases of 1.2 billion euros. Natural gas – both pipeline and liquefied natural gas – accounts for two-thirds (66% or 773 million euros) of European purchases of Russian energy. Oil accounts for the remaining 32% (379 million euros).

Ahead of the EU in this anti-rating are China (5.7 billion euros), India (3.6 billion euros) and Turkey (3 billion euros). The fifth place is occupied by South Korea with purchases worth 564 million euros, 73% of which went to Russian coal due to the country’s growing electricity consumption.

The EU is the main buyer of Russian gas despite the war

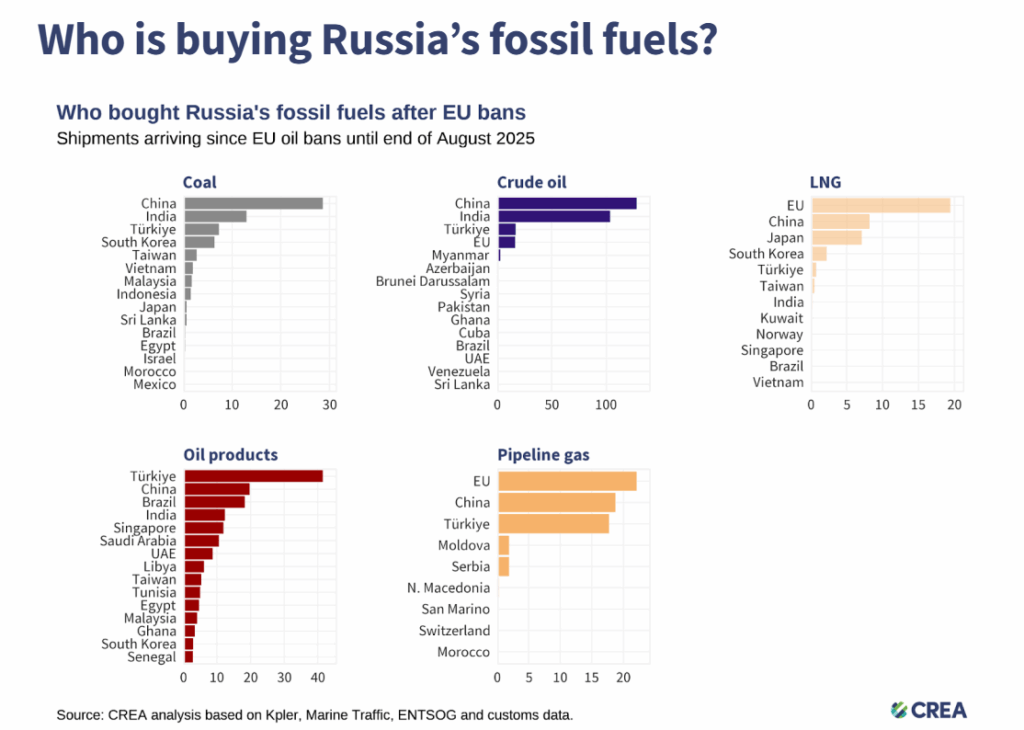

Most shockingly, the EU remains the absolute leader in purchases of Russian liquefied natural gas (LNG), buying half of this Russian fuel. The EU is also the leader in purchasing Russian gas through the pipeline.

At the same time, natural gas is not subject to European sanctions at all – this is the biggest gap in the sanctions regime.

That is why more than 60% of European payments to Russia are for gas supplies, which are carried out both through pipelines and in the form of LNG. In fact, the EU remains the largest buyer of two types of Russian fuel at the same time – LNG and pipeline gas, ensuring stable financing of the Russian budget.

At the same time, the EU does not shy away from Russian crude oil, being its fourth buyer after China, India, and Turkey.

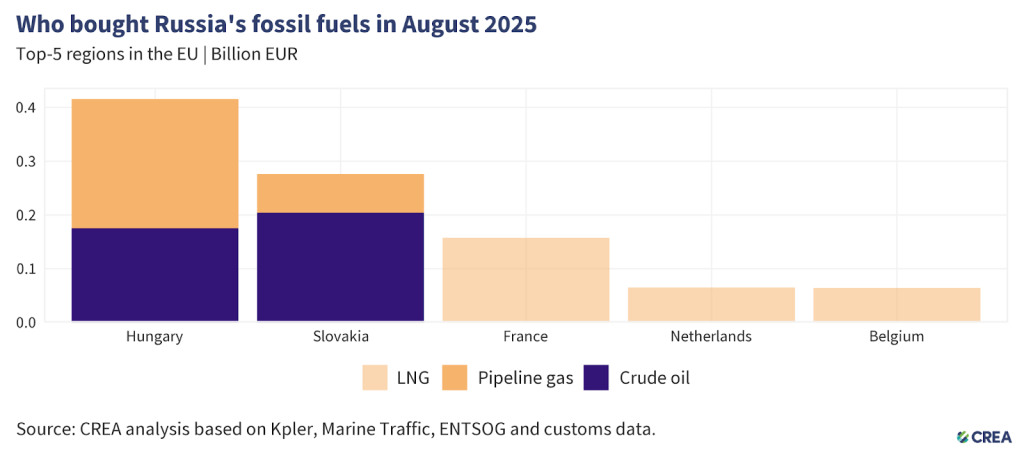

Hungary is a leader among European buyers

Hungary was the largest buyer of Russian fuel in the EU, spending 416 million euros on Russian energy in August. Of this amount, 176 million was spent on oil and 240 million on pipeline gas. Oil supplies to Hungary are carried out through the southern branch of the Druzhba pipeline under a special exception granted by the EU to this country.

Slovakia ranked second among European buyers with total purchases of 276 million euros. The lion’s share – 204 million euros, or 74% of the total – was oil, which is also supplied through Druzhba. Slovakia paid another EUR 72 million for pipeline gas. It is noteworthy that the exemption that allowed Slovak refineries to process Russian oil and re-export products to the Czech Republic expired on June 5.

France buys Russian gas for Germany

The third largest purchaser was France, which spent 157 million euros on Russian fuel exclusively in the form of liquefied natural gas (LNG). The researchers note an interesting fact: not all of this gas is consumed in France itself – part of the LNG coming through the Dunkirk terminal is subsequently delivered to Germany.

The Netherlands and Belgium round out the top five largest European importers, purchasing 65 and 64 million euros worth of Russian LNG, respectively.

Russia’s revenues fall for the third month in a row

In August, Russia’s total revenues from fossil fuel exports amounted to 564 million euros per day, which is 2% less than in July. This is the third month in a row that Russia’s energy export revenues have been declining.

Revenues from marine oil deliveries fell the most – by 12% to €170 million per day, reaching the lowest level in 2025. At the same time, revenues from pipeline gas increased by 8% to EUR 75 million per day, and from coal by 7% to EUR 76 million per day, reaching the highest level of the year.

The shadow fleet is gaining strength

Of particular concern to researchers is the growing role of the so-called “shadow fleet” in the transportation of Russian oil. In August, only 53% of Russian oil supplies were carried by tankers from the G7 countries, which is 8 percentage points less than in July. This indicates renewed dependence on “shadow” vessels.

A quarter of the oil delivered by shadow tankers was transported by vessels that are currently under sanctions. These sanctioned tankers transported 12% of Russia’s oil exports in August.

Of the 400 vessels exporting Russian oil and oil products, 125 belong to the “shadow fleet,” and 38 of them are over 20 years old. Such old vessels with questionable maintenance and insurance records pose serious environmental and financial risks to coastal states.

Recommendations for strengthening sanctions

The researchers propose several measures to increase pressure on the Russian economy. First of all, they recommend reducing the price ceiling for Russian oil from the current 47.6 to 30 dollars per barrel. This would still be significantly higher than the cost of Russian production, which averages $15 per barrel.

Experts estimate that such a measure could reduce Russia’s oil export revenues by 40% (153 billion euros) since the introduction of EU sanctions in December 2022. In August 2025 alone, a price cap of $30 would reduce Russian revenues by 38% (3.71 billion euros).

Experts also call for stricter control over the “shadow fleet,” including a ban on transshipment of Russian oil in the waters of the G7 countries, stricter marine insurance requirements, and closing loopholes that allow the re-export of petroleum products made from Russian oil.

Conclusions

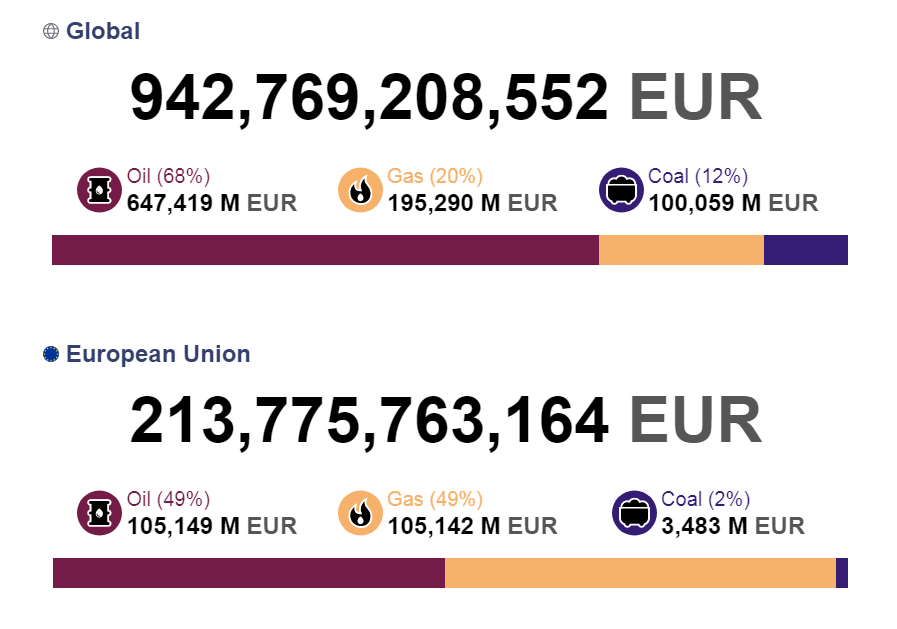

The study shows that despite all the statements about “energy independence”, “refusal from Russian fuel” and “support for Ukraine as long as necessary”, the European Union remains one of the main financiers of the Russian military economy, transferring billions of euros to Moscow every month.

In total, according to CREA, since the beginning of the full-scale Russian invasion, the European Union has purchased 213 billion euros worth of energy from Russia.

About the authors of the study

The Center for Research on Energy and Clean Air (CREA) is an independent research organization that specializes in studying the trends, causes, and health effects of air pollution and finding solutions to these problems.

The organization uses scientific data and research to support the efforts of governments, companies and activist organizations around the world in their transition to clean energy and clean air. CREA is registered as a non-profit organization in Finland, with staff working throughout Asia and Europe. The center’s work is funded by charitable grants and revenue from commissioned research.

Читайте нас у Telegram: головні новини коротко