Close the case for a donation: Tsivinsky conducts a survey on the “new” idea of the BEB

17 February 22:56

The Economic Security Bureau of Ukraine (ESB) has launched a public discussion of an initiative on pre-trial settlement of tax offenses. This is a mechanism whereby a company that admits to a violation pays taxes, a fine, and an additional payment to the budget (for example, 50% of the amount evaded in the form of a donation to the Armed Forces of Ukraine), after which the criminal proceedings are closed, according to "Komersant Ukrainian", citing a survey.

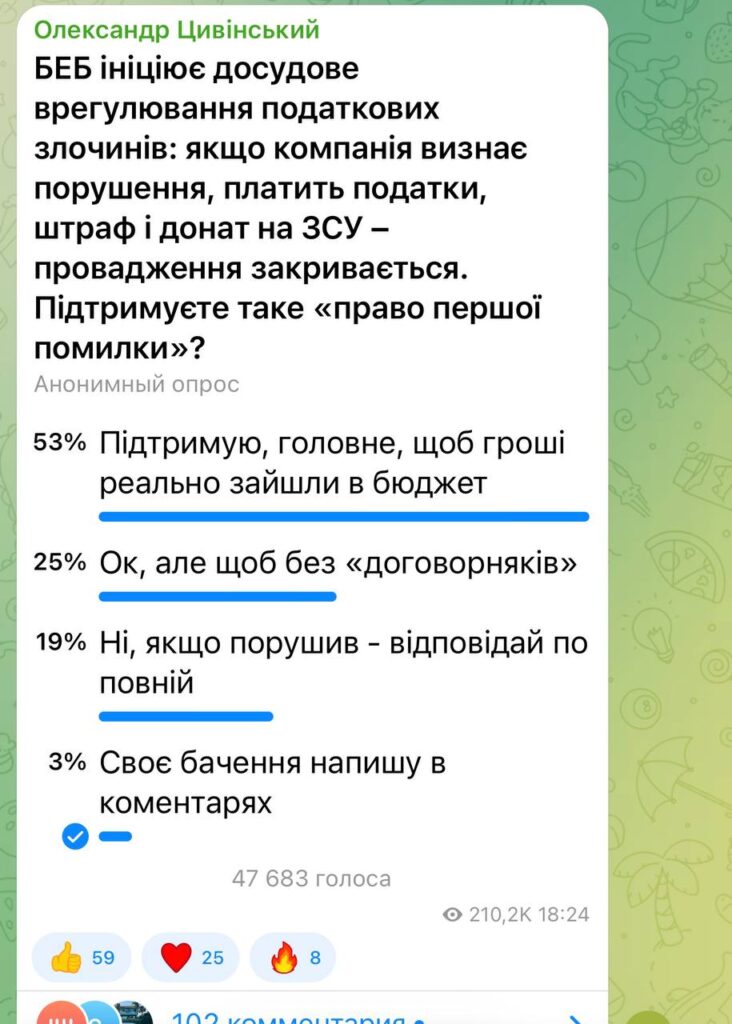

The survey is posted on the Telegram channel of BEB Director Oleksandr Tsivinsky. According to the BEB, the purpose of this proposal is to quickly fill the budget and focus resources on more serious crimes.

How to vote

The anonymous poll offers four options, with over 47,000 participants already taking part in the vote, and their “votes” are currently distributed as follows:

- I support it if the funds actually go to the budget – 53%

- Yes, but without “backroom deals” – 25%

- No, if you break the rules, you must take full responsibility – 19%

- my own position in the comments – 3%.

The discussion continues in the comments, of which there are already over a hundred.

Arguments “for”

Supporters of the idea emphasize the pragmatic nature of the approach: quick compensation for losses to the state and the Armed Forces without lengthy court proceedings.

There is also a thesis that the “right to the first mistake” could be a chance for businesses to correct violations without criminal consequences.

Watch us on YouTube: important topics – without censorship

Arguments against

Critics warn of corruption risks, in particular, raising the question of whether “the BEB has sufficient powers to conduct inspections,” as well as how to avoid underestimating amounts during inspections and informal agreements.

Separately, commenters pointed out that the idea of the BEB has long been provided for by current legislation.

“Am I the only one who thinks this is already provided for in Part 4 of Article 212 of the Criminal Code? A person who has committed the acts provided for in parts one and two of this article, or the acts provided for in part three, as they have led to the actual non-receipt of funds in particularly large amounts by budgets or state target funds) of this article, shall be exempt from criminal liability if, prior to being brought to criminal liability, taxes, fees (mandatory payments) have been paid and the damage caused to the state by their late payment (financial sanctions, penalties) has been compensated,” writes, for example, a user with the nickname Oleg.

What’s next

Public surveys and discussions are still ongoing.

What practical consequences this will have and how the initiative can be legally formalized in the future is not yet known.

Read us on Telegram: important topics – without censorship