Fuel in Kyiv: who controls a quarter of the Ukrainian market despite the war

10 September 22:07

The Kyiv region has traditionally been a key center of fuel consumption in Ukraine. In 2024, fuel spending here reached $2 billion, which is a quarter of the total for the country, "Komersant Ukrainian" reports, citing the consulting company NaftoRynok.

Its analysts say that the war has had a significant impact on the economy, but the demand for fuel in the capital remains stable, as Kyiv is a transportation hub and center of business activity.

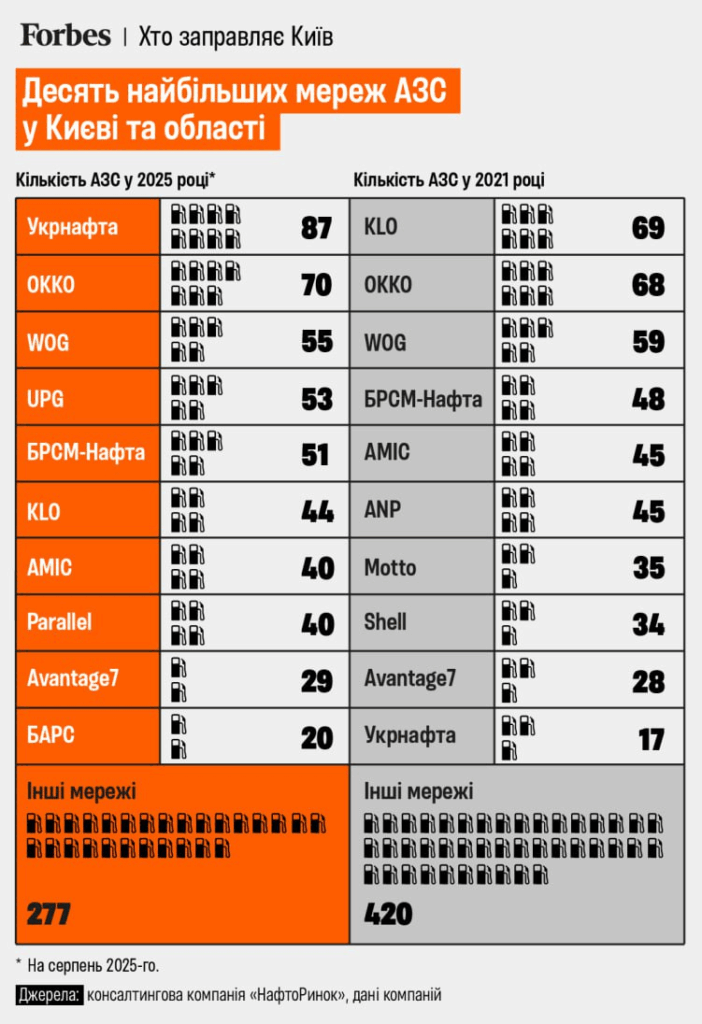

Who are the leaders in the fuel market in Kyiv region

Ukrnafta, which has an extensive network of filling stations, is the leader in terms of the number of filling stations in Kyiv and the region. At the same time, OKKO is the leader in terms of sales, which demonstrates a strong logistics base and a stable customer base. The third player in the top is WOG, which has retained its recognition and customers after the transformation of its ownership structure in the Continuum group.

Old players are losing ground

The KLO chain, which was one of the most prominent players in the capital’s market a few years ago, has significantly reduced its presence. Due to the expiration of lease agreements, the company lost 36% of its gas stations in Kyiv, leaving only 44 stations. This shows how important long-term lease agreements and financial stability of companies in times of war are in the gas station market.

Newcomers redistributing the market

While the old players are retreating, new networks are actively occupying niches. UPG managed to gain a foothold by leasing the assets of Privat Group and now has 53 filling stations. Another newcomer, BARS, has launched 20 filling stations, half of which are concentrated in the capital region.

Parallel, which acquired the Motto chain and immediately gained 40 filling stations in Kyiv and the region, has also taken its place among the leaders. This is an example of how the acquisition of assets can quickly become one of the top players in the fuel business.

Figures and trends in the capital’s fuel market

In 2025, there are 766 filling stations in Kyiv and the region, which is 14% of all stations in the non-occupied territory of Ukraine. Compared to 2021, the number of gas stations has decreased by 12%, but competition has not decreased – on the contrary, it has increased due to active market redistribution.

Several factors explain this trend:

- change of ownership and lease agreements;

- the emergence of new players with capital;

- increased demand for fuel in the capital, which remains stable even in wartime.

Read also: Fuel is illegal: the number of illegal gas stations is growing in Ukraine

Who is behind the well-known brands

WOG is owned by businessmen Serhiy Lagur and Svitlana Ivakhiv.

OKKO, which was part of Galnaftogaz, is actively investing in the development of services and new technologies.

Ukrnafta is controlled by the state and remains the largest player by number of filling stations.

This ownership structure shows that the interests of both state-owned companies and private groups are intertwined in the market, creating a certain balance of power.

Fuel market in Ukraine: what trends do experts see?

Analysts predict that competition in the market will only increase. The emergence of new players and the diminishing role of small networks will lead to further concentration of capital. At the same time, demand for fuel in Kyiv will remain high due to the city’s role as an economic and logistics center.

Дивіться нас у YouTube: важливі теми – без цензури

For consumers, this will mean a wider choice of services and loyalty programs, but it is unlikely that prices will drop significantly, as the fuel business operates under high logistics costs and dependence on external suppliers.

Читайте нас у Telegram: головні новини коротко