There will be no benefits for electric cars from 2026: Government rejects budget amendment

6 November 10:54

Starting from January 1, 2026, Ukraine will cancel the possibility of duty-free import of electric vehicles. The government rejected the corresponding amendment to the draft State Budget 2026, which provided for the extension of the preferential regime for another year. This was announced by MP Yaroslav Zheleznyak, "Komersant Ukrainian" reports

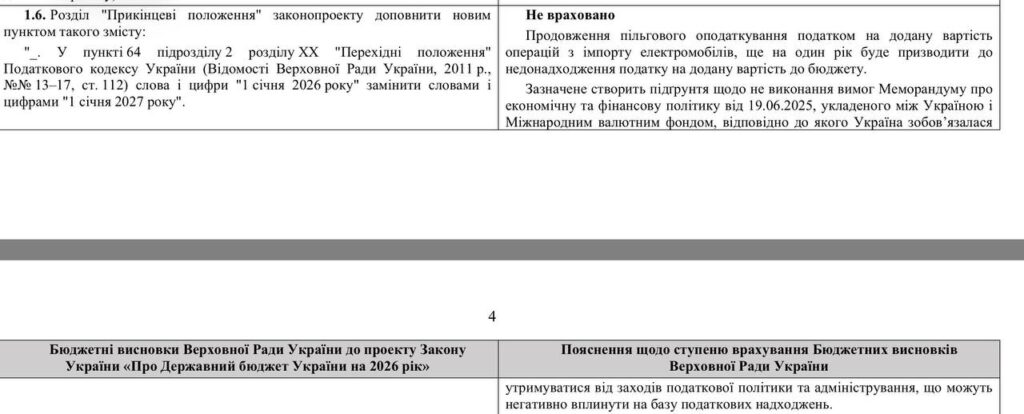

According to him, even though this amendment was previously considered by the Verkhovna Rada, the Ministry of Finance insisted on its exclusion.

“For those who were expecting the extension of the electric car tax exemption for another year, don’t expect it. Despite the fact that the amendment was considered by the Parliament, it was rejected by the Government. The chance to change this is minimal, so I am convinced that there will be no benefit,” Zheleznyak said.

Why did the government refuse the tax break?

According to the MP, the Ministry of Finance justified its decision with two key reasons

- losses to the state budget due to the shortfall in customs payments;

- obligations to the International Monetary Fund, which provide for a gradual reduction of tax benefits and an increase in budget revenues.

Thus, starting in 2026, imports of electric vehicles to Ukraine will again be subject to value added tax (VAT) and customs duties.

What it means for buyers

The abolition of the exemption means that the cost of new and used electric cars from abroad may increase by 20-25%, depending on the model and country of import.

For example, if an electric car currently costs $20,000, the price may rise to $24-25,000 after all taxes are paid.

The preferential regime for electric vehicles in Ukraine has been in place for several years in a row and has helped to stimulate the development of the eco-transportation market. As a result, the share of electric cars in the import structure grew year after year, and Ukraine was among the top 10 countries in Europe in terms of fleet electrification.

However, in 2026, the government is focusing financial resources on defense and social stability, which influenced the decision to abandon tax preferences in the transportation sector.