Abolition of the $800 duty-free threshold: how shipping prices from Ukraine to the US will change

26 August 22:17

Starting August 29, Ukrainian postal operators will increase tariffs for deliveries to the United States due to new customs rules introduced at the initiative of US President Donald Trump. This is reported by "Komersant Ukrainian" with reference to a Facebook post by Ukrposhta CEO Ihor Smelyansky.

Smelyansky explained that while previously more than 98% of postal items were subject to the $800 parcel limit and imported into the United States duty-free, now 100% of commercial shipments are subject to fees. The only exceptions are documents and gifts under $100, which, of course, will still be subject to additional checks to ensure that they are really gifts.

After the introduction of the new tariffs, most European postal and logistics companies limited deliveries to the United States to documents or gifts. At the same time, the national postal operator said it will continue to deliver parcels, but will be forced to raise prices.

According to Smelyansky, the cost of shipments to the US will increase by $1.5-3 depending on the category and weight. At the same time, he emphasized that due to “intensive negotiations 24/7,” Ukrainian entrepreneurs will be able to continue doing business on American platforms such as Amazon, Etsy, eBay, and Shopify.

In addition, Ukrainian goods will become more expensive for American consumers by 10% – the amount of the duty that US President Donald Trump imposed on Ukraine.

Read also: Trump’s new duties: what Ukrainians who send goods to the US via Ukrposhta need to know

trump’s “customs war” and competitive opportunities for Ukrainian business

Ukrposhta CEO Ihor Smelyansky noted that the current situation may even create certain competitive advantages for Ukrainian exporters.

“Despite the new tariffs, our entrepreneurs do not lose the opportunity to sell goods in the United States. This allows us to save jobs and foreign exchange earnings in Ukraine,” he emphasized.

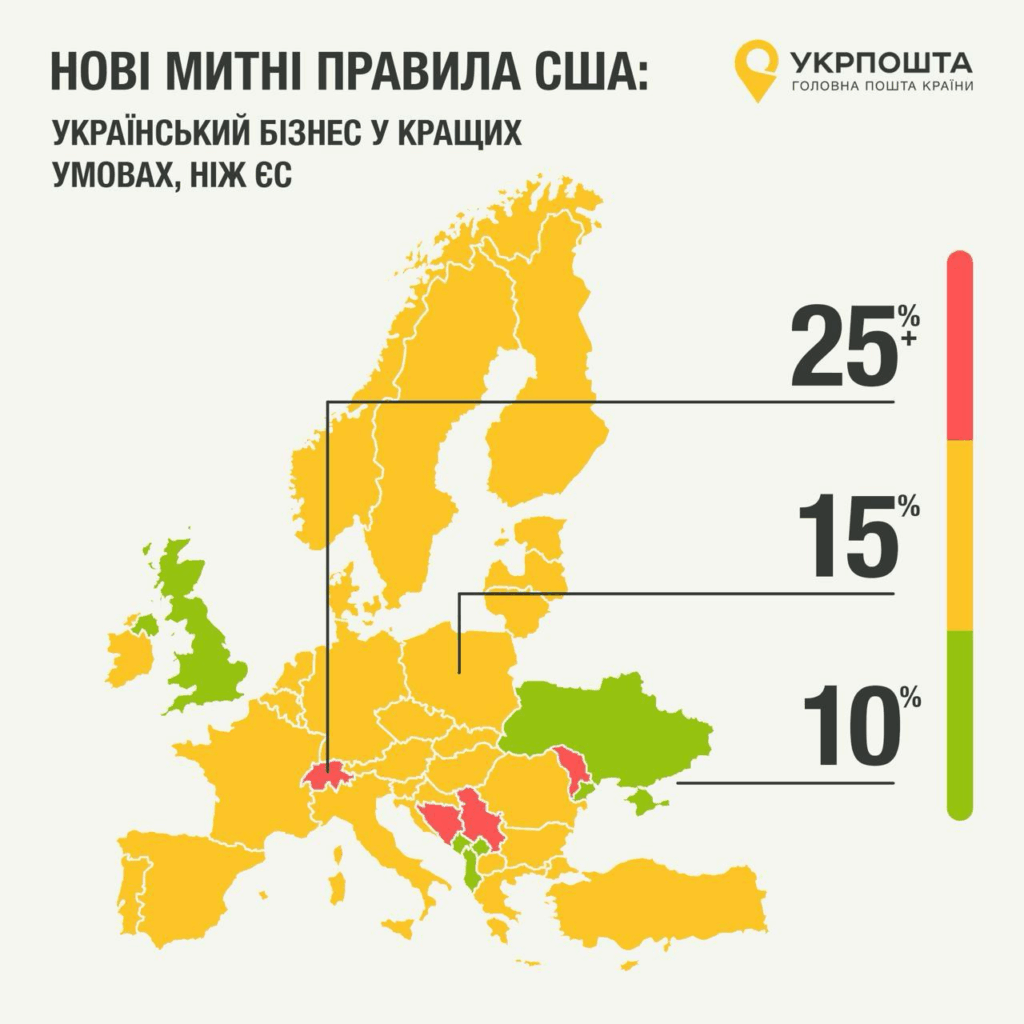

In addition, Ukraine’s 10% duty rate is the lowest in Europe, where other countries have tariffs ranging from 15% (major EU countries) to 25% (Moldova) and even 39% for Switzerland.

Mr. Smelyansky emphasized that Washington has obliged operators to collect customs duties in the territory of the sending country. Many private companies are already introducing separate brokerage fees or significantly increasing the existing ones.

Ukrposhta has taken a different approach: there will be no new fees. We take care of all additional costs, as well as agreements with airlines, because many of them no longer accept mail to the United States,” explained the CEO.

What the new conditions for sending parcels to the US will change for Ukrainians

The national postal operator explained that given Ukraine’s competitive advantage over the EU (where the duty is 15%) or Moldova (where the duty is 25%), it will strengthen control at border offices to avoid accusations of re-exporting goods from countries with higher customs duties.

Also, Ukrainians were asked not to “play the lottery” and not to indicate the category of “gifts” in their commercial shipments, as the US will now tighten control over mail from other countries.

Changes in international logistics and Nova Poshta’s policy

Meanwhile, Nova Poshta announced that starting from August 26, 2025, it will add 10% of the cost of delivering parcels to the United States if the sender is the payer. If the costs are covered by the recipient, then another $25 is added to this amount for customs brokerage services.

How the new US rules will affect Ukrainian exports

Analysts note that the new rules in the US may affect the cost of Ukrainian goods for end consumers, but thanks to the flexibility of Ukrainian postal operators, small and medium-sized businesses retain access to the US market. In the context of wartime, this is of strategic importance for supporting Ukrainian exports and entrepreneurship.

What you need to know about the duties imposed by US President Donald Trump

Information about the abolition of the preferential duty-free threshold for small parcels – the so-called de minimis – in the United States emerged after the publication of President Donald Trump’s decree in May 2025.

According to the document, starting from August 29, 2025, the “up to $800 ” rule will cease to apply to all commercial shipments (except for documents and gifts worth up to $100) imported into the United States.

The document’s interpretation of “activities harmful to economic security” made it possible to declare that the duty-free threshold does not apply to any country – not even to allies. The de minimis system was enshrined in Section 321 of the U.S. Customs Act and has been widely used by Chinese online platforms to circumvent tariffs in recent years.

In its announcement, the White House explained that the decision was aimed at stopping abuses, protecting domestic production, and reducing budget losses

Background and reasons for the changes

In 2016, the threshold for duty-free imports to the US was raised to $800. This greatly simplified the importation of goods by mail or courier services and facilitated the development of cross-border e-commerce. However, after the Trump administration imposed high duties on goods from China in 2018-2019, the volume of “splitting” shipments under the $800 threshold increased dramatically. American manufacturers complained about unfair competition: thanks to the exemption from import duties, Chinese and Turkish companies shipped billions of small shipments without paying tariffs. According to Congress, in 2023 alone, more than a billion de minimis parcels were imported into the United States, costing the budget several billion dollars. The decision of August 2025 to abolish the threshold was intended to close this “hole”.

Дивіться нас у YouTube: важливі теми – без цензури

What to expect next

The abolition of the threshold has drawn criticism from trade associations, which point to an increase in costs for small exporters and consumers. However, the White House expects that tighter customs policy will reduce the flow of “pseudo-gifts” and increase government revenues.

Many economic and logistics experts predict that Congress will try to legislatively reform the de minimis system. For example, to retain the privilege for “friendly” countries, but to ban it for suppliers from China and Russia.

In any case, Ukrainian businesses should prepare for the new tariffs and fill out customs declarations more carefully, as orders to the US will no longer be able to avoid paying duties as small parcels.

Читайте нас у Telegram: головні новини коротко