Escape to a “safe haven”: what’s behind the record growth of gold and silver in the world

28 January 19:45

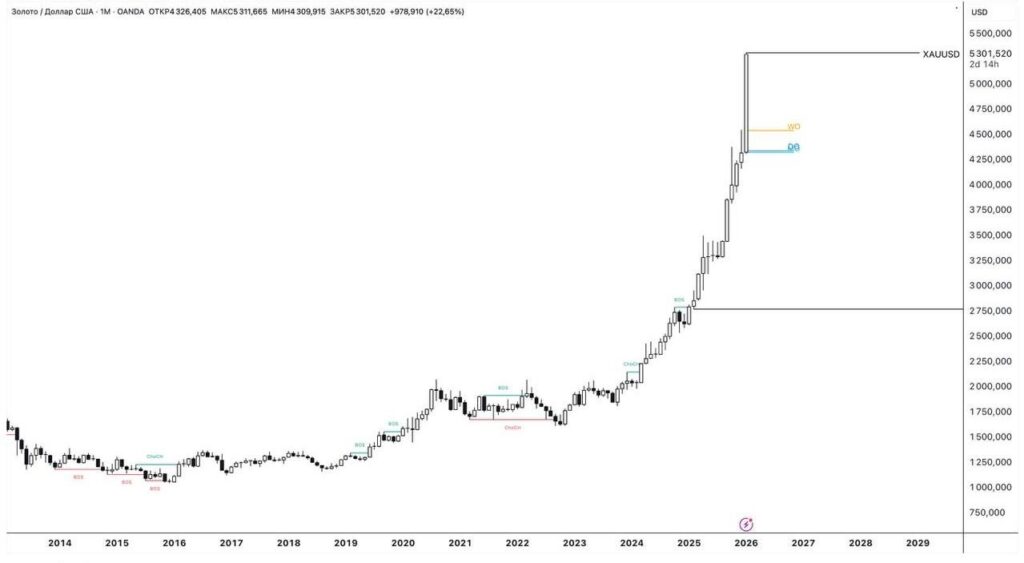

On Wednesday, January 28, gold prices hit a new all-time high, exceeding $5,200 per ounce. The price increase comes amid a weakening US currency and a shift in investor sentiment, with investors pulling funds out of government bonds and currency assets.

This was reported by Bloomberg.

According to the agency, on Wednesday, the price of gold bars rose 1.3% after jumping 3.4% during the previous trading session, the strongest one-day gain since April.

At the same time, the price of silver rose by almost 3% and ended trading near a record high of over $117 per ounce, recorded at the beginning of the week.

Overall, gold rose 1.1% to $5,234.64 per ounce, while silver rose 2.5% to $114.92. Platinum and palladium also showed positive dynamics.

Growth factors

The rise in precious metal prices is happening against the backdrop of a weaker US dollar, growing geopolitical tensions, and investors moving away from currencies and sovereign debt instruments.

US President Donald Trump said he sees no problem with the dollar falling to its lowest level in nearly four years, stressing that currency fluctuations are natural.

The US dollar index fell 1.1% on Tuesday, its biggest daily drop since April. As a result, gold and other metals became more affordable for buyers outside the US, which further supported demand. Since the beginning of the year, the price of gold has risen by more than 20% and exceeded $5,000 per ounce for the first time this week. Silver has risen more than 50% over the same period.

Analysts also cite active purchases of precious metals by central banks, an influx of investments in gold-backed exchange-traded funds, and traders’ expectations of further price increases as additional drivers of growth.

Global gold prices are rising, but not for Ukraine

The rapid rise in gold prices on world markets is a direct consequence of the weakening of the US dollar and its declining investment attractiveness. However, these processes are of little significance to Ukrainian consumers and investors.

This was stated in an exclusive comment for

According to the expert, the rise in the price of gold is a typical reaction of financial markets to the instability of key currencies.

“When the investment attractiveness of the dollar deteriorates sharply, investors start to flee to gold. What we are seeing now is a consequence of these very processes,” Pendzin explains.

At the same time, the economist emphasizes that the situation on global exchanges has no direct impact on Ukraine, as the country lacks a fully-fledged monetary gold market.

“There is currently no gold market in Ukraine. The figures we are talking about now — the sharp rise in the exchange rate, the sharp rise in the price of gold — relate exclusively to the global market, not Ukraine,” he notes.

Jewelry is not an investment

Separately, Pendzin warns Ukrainians against trying to view jewelry as a form of investment.

“If you want to sell a piece of jewelry, in the best-case scenario, it will be bought at the price of scrap gold, not at the cost of jewelry,” says the economist.

According to him, it is not worth expecting an increase in income from reselling jewelry.

“Today, it makes no sense to buy jewelry in the hope that gold will rise in price. At most, you will get about 50% of the price you paid for the item,” Pendzin emphasizes.

The expert also draws attention to the significant gap between the purchase and sale prices of gold in Ukraine.

“Jewelry can be valued at less than two thousand hryvnia per gram when purchased. This is normal for our market. But when you buy, you will pay all five thousand per gram,” he explains.

Pendzin is convinced that the rapid growth of world gold prices does not create investment opportunities for the Ukrainian market. In the absence of a developed monetary gold market and transparent mechanisms for trading precious metals, gold in Ukraine remains more of a consumer good than an instrument for preserving or increasing capital.

The Chinese factor and demand for precious metals

The record rise in the price of gold and silver is not a sign of random fluctuations, but of a systemic loss of confidence in traditional financial instruments.

This was stated by Taras Zagorodniy, managing partner of the National Anti-Crisis Group.

“This is more related to global investor uncertainty. The issue is not local — it concerns the huge debts of developed countries and possible major conflicts, particularly between the US and China,” the expert noted.

According to Zagorodniy, one of the key drivers of gold price growth is the active policy of China, which is systematically increasing its reserves of the precious metal.

“Gold is gold. Stocks may vary, but for thousands of years, gold has been considered the equivalent of wealth and a reliable investment asset,” he emphasized.

At the same time, he said, not only gold is showing growth, but also silver, which was not previously perceived as a classic instrument for preserving capital.

“Even silver, which has never been considered a key investment asset, is breaking records today. This means that the world understands that something is coming,” Zagorodniy stressed.

According to the expert, Donald Trump’s economic policy, which has the potential to provoke a new wave of global instability, could be an additional risk factor.

“Everything he does could lead to a scenario of a great depression — a deep economic crisis,” said the managing partner of the National Anti-Crisis Group.

At the same time, Zagorodniy believes that such a scenario could be beneficial to the US economy itself.

“Gold is the main safe haven”: traders’ assessments

The main factor behind the sharp rise in the price of gold has been the unpredictable policies of US President Donald Trump, both domestically and internationally. This is what is forcing investors to move their capital into safe-haven assets.

He discussed this in a conversation with journalists

According to him, in conditions of political instability, gold is traditionally perceived as the most reliable instrument for preserving value.

“The reason for the rise in gold is Trump’s unpredictable policies, both foreign and domestic. Because of this, investors are transferring funds into gold to preserve their assets, as it has the highest capitalization and is the safest asset in such times,” Potapenko explains.

Pressure on the dollar and US bonds

According to the trader, the growth in demand for gold is directly reflected in other key financial instruments.

“The consequences of these processes are a fall in the dollar exchange rate and a decline in the value of US bonds,” he notes.

Potapenko emphasizes that the rapid rise in prices is changing the approach of market participants, especially in the futures segment.

“Traders are becoming more conservative. If gold is being bought, it is necessarily with profit-taking and a maximally cautious approach,” says the expert.

According to him, after sharp jumps, the market usually enters a correction phase.

“After such rapid growth, the market usually undergoes a price correction. When exactly it will begin depends on the political situation and may even start after a tweet from Trump,” Potapenko concludes.

Thus, the record growth in gold and silver prices has become a concentrated reflection of global economic and political uncertainty. The weakening of the US dollar, geopolitical risks, active purchases of precious metals by central banks, and growing distrust of traditional financial instruments are forcing investors to return to “safe havens.”

At the same time, for Ukraine, this trend is more informational than practical: in the absence of a full-fledged monetary gold market, precious metals do not function as an investment instrument. Thus, the world perceives gold as a hedge against future shocks, while for the Ukrainian market, it remains primarily a consumer good rather than a means of preserving or increasing capital.