The IMF demands that the Ukrainian government abolish privileges for the self-employed: what does this mean for individual entrepreneurs?

19 November 2025 17:45 ANALYSIS FROM

ANALYSIS FROM The International Monetary Fund has traditionally offered the Ukrainian government its vision of how to increase budget revenues in the context of budget discussions. It is not very original. This time, these demands include not only an increase in gas prices for households and devaluation of the hryvnia, but also the abolition of benefits for the self-employed. What is it about and is there really a reason to worry, "Komersant Ukrainian" tells.

There will be no tax increase next year. With this statement, Danylo Hetmantsev, chairman of the parliamentary finance committee, recently tried to reassure Ukrainians who have long been accustomed to tension, watching every year as the government and MPs try to balance the budget. And information sources from the IMF headquarters, where they are deciding whether to sign a new four-year loan program worth $8 billion with Ukraine, only reinforce such fears. Because money for the budget has to be found somewhere.

In addition, if necessary, it can be argued that the abolition of benefits for the self-employed, which the IMF seems to be talking about, is not a tax increase.

Who does the IMF want to “make happy”?

A self-employed person is, as explained by the State Tax Administration, a taxpayer who is an individual entrepreneur or conducts independent professional activities, provided that such a person is not an employee within such entrepreneurial or independent professional activities. While there were only more than 28 thousand self-employed individuals, i.e. professionals engaged in independent professional activities, registered in Ukraine as of the beginning of June 2025, the State Statistics Service counted as many as 1,773,900 individual entrepreneurs as of October 1, 2025. So it is clear who the IMF representatives primarily focused on when they stated that it was advisable to cancel the benefits. But how correct is it to talk about the abolition of privileges? Entrepreneurs have their own opinion on this.

According to the Alliance of Regional Small Business Associations (ROSBA), the simplified taxation system, which is used by most individual entrepreneurs, does not contain tax benefits. On the contrary, it has clear limitations: by type of activity, by number of employees, and by turnover.

This is not a privilege, but a regulated regime for small businesses. In fact, the concept of “privileges” is sometimes manipulatively used by opponents of the simplified taxation system. But the simplified taxation system was introduced not as an exception to taxation, but as a tool to reduce the administrative burden, which helps 1.7 million entrepreneurs to work legally,” the ROMB Alliance states.

Maksym Malyovanyi , entrepreneur, chairman of the NGO BUSINESS EDUCATION INSTITUTE, member of the National Platform for Small and Medium Business, agrees.

The simplified taxation system has its own nuances, but it is a simple system that really saves small businesses. Because it’s a quick start, a fixed tax, minimal reporting, and you just go about your business in peace. You don’t think about accounting and inspections every day. You need to understand that those who do not play by the rules are definitely not more than 10-15%. But if we focus on the majority, then we must understand that this simplified system must remain,” the entrepreneur emphasizes.

“When the IMF talks about abolishing benefits for the self-employed, most likely, according to the ROMB Alliance, they mean reforming the simplified tax system, reducing opportunities for abuse, and increasing control over the income of individual entrepreneurs, especially those who work through digital platforms.

Who should be brought out of the shadows

The key internal resource for sufficiently filling the state treasury is de-shadowing. This is another thesis that Danylo Hetmantsev never tires of repeating.

The law is one for all. Every shadowy person and everyone involved in their schemes will eventually realize this,” the MP said once again not long ago.

“But not everything is so simple. For example, the implementation of the e-excise tax reform is apparently being postponed. Accordingly, as the parliamentarian himself admitted, the de-shadowing of the tobacco and alcohol markets is also being hampered. And the budget was counting on this resource. And it will need to be compensated for in some way.

Small business representatives realize that the main thing the IMF wants is to reduce the shadow economy. The Alliance of Regional Associations of Small Businesses also understands why the individual entrepreneurs are being mentioned again in the context of the abolition of tax privileges.

When the IMF talks about revising tax privileges, they mean billions of dollars in exemptions for big players – sectoral special regimes, VAT loopholes, customs preferences, and other schemes that really eat away at the budget. But Ukrainian officials keep shifting the conversation to individual entrepreneurs because it is difficult and risky to touch the real beneficiaries. The IMF does not demand that the simplified taxation system be abolished; it demands that corruption loopholes be closed. But instead, we are looking for “guilty” among small businesses again and again, because individual entrepreneurs are the easiest, easiest and safest prey for the authorities,” the Alliance notes.

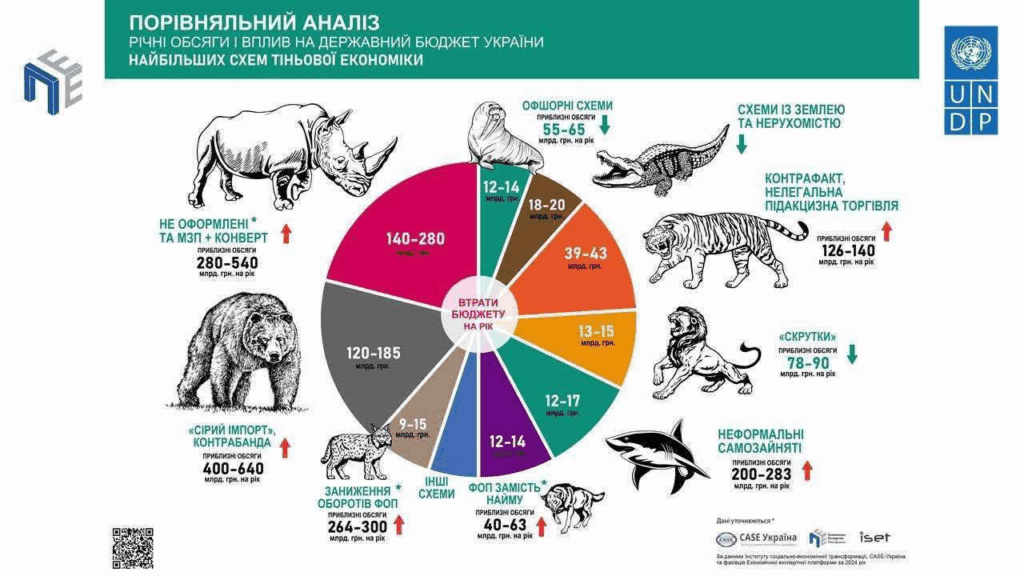

But is small business the main source of “shadow problems”? It is unlikely. This is confirmed by last year’s analysis of key tax avoidance schemes and calculations of the amount of losses to the state from these schemes, which were carried out by experts from the Institute for Social and Economic Transformation and the Center for Social and Economic Research CASE Ukraine.

The Alliance of Regional Associations of Small Businesses reminds that “the simplified system remains an effective mechanism: it ensures economic activity of the largest stratum of citizens, stimulates self-employment, reduces the level of shadowing and allows the budget to focus on those who really need support.”

An attempt to complicate or limit the simplified taxation system may have the opposite effect. Maksym Malyovanyi, head of the NGO BUSINESS EDUCATION INSTITUTE, continues.

“If you don’t trust, if you regulate more heavily, then, of course, the desire to legally register and legally conduct business will decrease. Motivation will decrease. There will be a growing desire to simply go into the shadows,” the entrepreneur notes.

Representatives of small businesses warn that a sharp or ill-considered restriction of the simplified taxation system could have negative consequences for employment, local economies, the creation of new businesses, and lead to an outflow of human capital.

Author – Sergiy Vasilevich

Read us on Telegram: important topics – without censorship