Which regions have increased payments to the state budget and how the war has changed the tax map of Ukraine

24 March 19:29

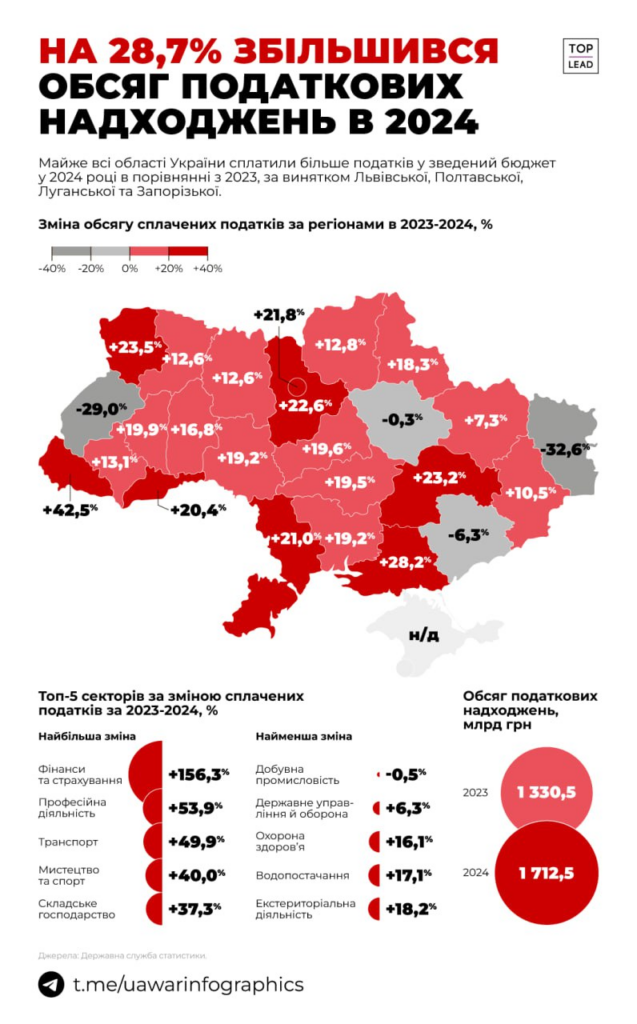

Despite the war, unstable economy, and ongoing threats to infrastructure, Ukraine is showing signs of financial resilience at the local level. Budget revenues increased by 28.7% compared to the same period in 2023. This is reported by "Komersant Ukrainian" with reference to the data provided by the State Tax Service.

Leaders in terms of tax revenue growth

These regions have seen an increase in personal income tax, single tax, land rent, and excise taxes, which are the main sources of local budget revenues.

Regions with the highest revenue growth:

- Zakarpattia region – 42.5%

- Kherson region – 28.2%

- Volyn region – 23.5%

- Dnipropetrovs’k region – 23.2%

- Kyiv region – 22.6%

- Odesa region – 21%

- Chernivtsi – 20.4%

These data indicate an increase in business activity and stabilization in a number of regions despite the war.

Key sources of revenue

- PIT (personal income tax) is the main source of local budgets;

- single tax from individual entrepreneurs;

- land payment;

- excise tax on fuel and alcohol.

What contributed to the growth of tax revenues

Business relocation. In 2022-2023, hundreds of businesses were relocated from the active combat zone to the western and central regions. These companies are now operating and paying taxes at their new places of registration.

Labor market stabilization. In many regions, the government managed to maintain or restore employment levels, which ensured stable personal income tax (PIT) revenues.

Adaptation of small and medium-sized businesses. Despite the risks, small businesses are not only surviving but also developing, especially in the services, trade, and agricultural sectors.

Digitalization and transparency. Electronic reporting, digital registries, and automated tax tools have reduced the shadowing of income and increased the efficiency of collections.

Regional initiatives. Some communities are actively implementing local programs for business development, attracting investors, and supporting individual entrepreneurs.

What changes in the tax map of Ukraine mean for communities and the country

Strong local budgets allow communities to better plan social programs, road repairs, education, healthcare, and maintenance of property and equipment. This is also evidence that the economy is gradually adapting to wartime conditions and is able to operate even in an unstable environment.

At the same time, the tax service warns that maintaining this trend depends on the absence of new attacks on critical infrastructure, stable energy supply and predictable government policy.