The euro has lost value: an economist explains why we should not dramatize the situation

20 August 19:19 EXCLUSIVE

EXCLUSIVE

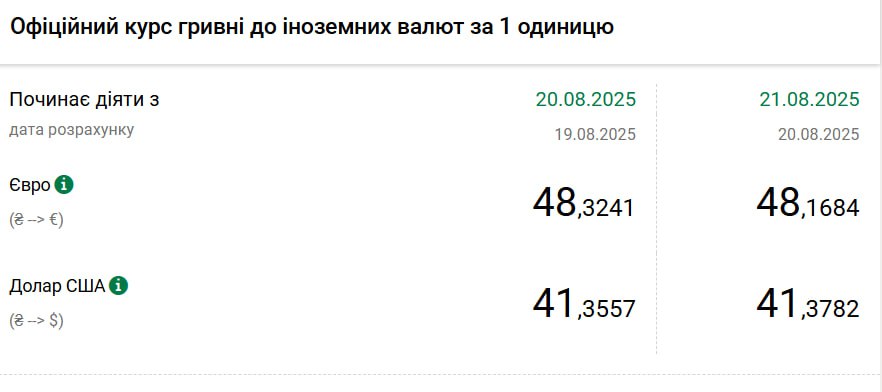

The National Bank of Ukraine (NBU) has set the official hryvnia exchange rate to foreign currencies for August 21, 2025. According to the regulator, the euro fell by 16 kopecks to UAH 48.16 per 1 euro (versus UAH 48.32 a day earlier), reports

At the same time, the US dollar rose by 2 kopecks to 41.37 UAH.

The strengthening of the hryvnia against the euro occurred amid moderate activity in the foreign exchange market and continued demand for the non-cash segment. Analysts emphasize that the key factors remain the NBU’s actions and the volume of foreign exchange earnings of exporters.

Experts note that Ukraine’s foreign exchange market remains relatively stable. The NBU adheres to the policy of “managed flexibility“, which allows it to smooth out excessive exchange rate fluctuations and maintain balance in the foreign exchange market.

In addition, in the second quarter, the NBU reduced net sales of foreign currency on the interbank market compared to the beginning of the year, while flexibly changing restrictions to avoid unproductive capital outflows.

At the same time, July was characterized by increased demand for foreign currency: according to the NBU, the volume of foreign exchange interventions on the selling side was higher, which also explains the relative stability of August quotes amid seasonal fluctuations in imports and exports.

The NBU attributes this development to balanced supply and demand in the FX market. The regulator refrains from harsh interventions, instead adhering to a regime of managed flexibility – the exchange rate is formed under the influence of market factors, but in case of excessive fluctuations, the central bank can smooth out the situation to avoid panic or speculation. Ukraine’s foreign exchange reserves remain at a sufficient level to ensure the stability of the hryvnia without drastic intervention.

Currency stability is also affected by seasonal factors. Importers’ activity traditionally decreases in August, which leads to a weaker demand for foreign currency. In addition, a significant volume of remittances from labor migrants in the summer supports the supply of foreign currency.

For businesses, this situation creates a predictable environment: exporters and importers can correctly plan cash flows and contracts without threats from exchange rate fluctuations. Households that buy euros for travel or savings do not face excessive currency appreciation or large spreads in exchange offices.

The exchange rate is expected to remain within the current range until the end of August, barring any external shocks or sudden changes in monetary policy.

Read also: The hryvnia may be pegged to the euro: how it will change the economy and life of Ukrainians

The same opinion is shared by economist Ilya Neskhodovsky, who gave an exclusive comment to

This does not mean anything. 16 kopecks – if you take into account the general exchange rate, it is a fraction of a percent. And such fluctuations will be constantly observed,” the expert said.

According to him, such changes in the exchange rate are normal under the managed flexibility regime currently applied by the NBU. The difference of a few kopecks may be due to situational factors: changes in demand for currency, reaction to international news, or the amount of currency intervention by the regulator.

But if the price increase is more than one percent in one day – that’s almost 50 kopecks – then we can talk about some serious trends in the market,” Neskhodovsky emphasized.

The expert also assured that there is no reason to expect sharp jumps in the euro in the near future. According to him, the last significant fluctuation was due to the news of the agreement between the US and the EU.

This could be a temporary situational demand for additional euros, a reaction to some news on global markets. It could be, in principle, the need for the National Bank to increase foreign exchange interventions or reduce foreign exchange interventions,” the expert said.

Дивіться нас у YouTube: важливі теми – без цензури

“After the market has absorbed this news, at least, there are no drastic changes,” he explained.

The economist added that if new geopolitical factors emerge, in particular those related to negotiations to end the war, the situation may change. However, for now, the market remains relatively stable, and we are talking about technical fluctuations rather than a long-term trend.

If there are any positive negotiations in Ukraine in the context of ending the war, if there is a movement towards certain agreements, then, of course, this will be reflected, including in the foreign exchange market, in the global markets, and then in Ukraine,” Neskhodovsky summarized.

Читайте нас у Telegram: головні новини коротко